Want to learn how to adjust the opening balance to match a statement in Quicken? Here we are, with a new article to resolve your issue with our expertise in this field. With Quicken if you are unable to reconcile your Quicken account with your paper statement then there might be the possibility that there is a difference in the opening balances. So, to know more about opening balance in Quicken you have to go through the whole article and learn it yourself. For any suggestion or help contact us toll-free:+1-855-525-4247

Let’s discuss then;

- Reconcile as far as you can and then click Done.

- And if there is an opening balance difference then to resolve them, Quicken asks for your permission whether you want to make your totals agree with your bank statement.

You can choose from the following options:

- You need to click Adjust to let Quicken make a change to your opening balance.

- After that click Cancel in order to return to reconciliation. And then try to resolve the differences by yourself.

Table of Contents

Steps to adjust the opening balance to match the statement are as follows:

First-time reconciliation

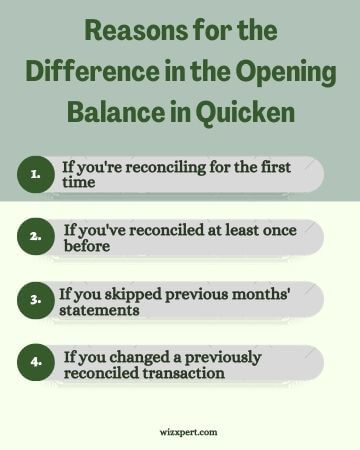

If you are reconciling for the first time, in that case, Quicken uses the opening balance transaction amount in your checking register as the Bank Statement Opening Balance in the Reconcile Bank Statement window. At the time of setting up the account, you may have entered a balance that was possibly different from the actual amount in your bank account. Probably transactions are missing from your Quicken account that affects the balance.

In case you have reconciled at least once before

Let’s understand this by taking an example. Suppose it’s July and you have recorded your transactions from May itself and after that reconciled your account for May/June.

After that, you went back and recorded transactions starting in January. And then you’ll notice that the ending balance in the register was incorrect after entering these transactions. So you update the date and amount of the original opening balance transaction that there is the record for Quicken in your register when you set up your account in May.

If you changed a previously reconciled transaction

In case if you have inadvertently changed or deleted a transaction that already had an R in the Clr field.

Quicken always seeks permission to confirm a change to a previously reconciled transaction.

And, if you have already ruled out other possible errors then you probably should continue with reconciliation and have Quicken record an adjustment transaction when reconciliation is complete.

In case you skipped previous months’ statements

If you have started reconciling with a current statement but you didn’t reconcile statements of each of the previous months.

Note: It is advised that you should reconcile one month at a time, starting with the earliest month. In case, you don’t have time for this then you can also allow Quicken to enter an adjustment for you.

Solutions to Fix “Quicken Account Balance Incorrect” Error

Quicken Account Balance Incorrect: If you found the Quicken account balance incorrect, you need to correct the balance for an account quickly by implementing the following methods one by one.

Solution 1: Make sure the account you are working on is correct.

When you are working on a lot of bank accounts at the same time in accounting software, sometimes you mistakenly mess up the accounts. Therefore, it becomes important to check whether you are working on the right account or not. To do this,

- First, click on the account name in the column present on the left-hand side of the main iBank window.

- Now go to Account and then select Adjust Balance and enter the proper current balance for the account and then click OK.

Solution 2: Find the Transactions that are recorded by the Bank but not you.

Sometimes, there are few transactions that you missed recording into Quicken but are present in the bank statements. Therefore, you need to verify the bank statements to check that you’ve recorded every transaction that has been recorded by the bank.

Transactions like cash withdrawal charges, special charges, penalties, service charges, etc are easily forgettable.

NOTE: If the difference between opening balance is positive then it means that you’ve not recorded the withdrawl transaction on the other hand if the difference is negative then it means you’ve not recorded the deposit transaction.

Solution 3: Verify the Reversed Transactions

Sometimes, you check and the window is displaying all the transactions correctly but the difference between the amount of the transactions is showing positive when it should be negative or vice versa.

This could happen when you had mistakenly recorded a deposit transaction as a withdrawal transaction or vice versa. This could also be the reason for the incorrect opening balance and you need to fix it.

Solution 4: Find a transaction that is equal to the difference.

There is a possibility that the difference between the bank record is equal to the one transaction in your register. Then you need to find that transaction and check whether you mistakenly marked that transaction as cleared or incorrectly left the transaction as uncleared.

Solution 5: Check for the Transposed Numbers

Transposed numbers are those numbers that contain the same digits but at different places like $36.54 and $35.64. Both the numbers have the same digits 3, 6, 5, and 4 but at different places. It is quite a common human error. You need to find this error and fix it.

Tips for finding the Transposed Numbers

- Divide the difference while reconciliation.

- You may have the transposed numbers if your register has an even number of dollars and cents.

- Check every transaction one by one.

Solution 6: Find Multiple Errors

If you are still getting your Quicken account balance incorrect then the only thing you can do is check for every list from which you are recording the transactions. For example, if you are using a laundry list then check it from top to bottom and look for the transposed numbers and then fix them. Repeat it for every statement.

Solution 7: Go to Bank fo Help

Even after implementing all the above-mentioned steps if the Quicken opening balance is still wrong then, at last, you should go to your bank and ask them to help you in reconciling your account. You can also ask them whether they are charging some additional hidden fees or not.

Although it is very rare that there is a mistake by the bank in recording the transaction but you should ask them to check once.

This procedure will help you in fixing your Quicken account that shows the quicken account balance incorrect. You can also take help from Quicken Support to fix this issue. When the Quicken account balance is incorrect at that time also may face the issue which is for not showing the balance in Quicken Essentials for Mac. Our technical experts are always available to help you in fixing your issue. Just follow these step-by-step processes to fix the issue.

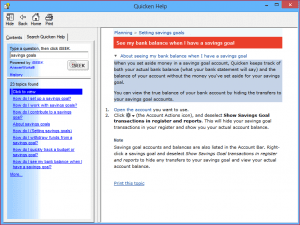

Important steps to show a running Balance in Quicken Essentials for Mac

- Initially, you need to click on the Reset Filters button.

- It is fine if it won’t look like anything happens.

- Now, click on the Date column header.

- You need to check whether it shows the oldest transactions at the top and the newest transactions at the bottom.

- In case if it doesn’t then click the Date column header again.

- And finally, your balance should now appear.

The Bottom Line

As we have discussed above all the steps regarding opening balance to match the statement in Quicken. And if you need any further assistance then you can contact our Quicken Support team. You can also dial our toll-free number 888 883-9555. We provide a 24/7 service so feel free to call anytime.