QuickBooks accounting software allows you to record various types of payments, including debit cards too. All the payment modes in QuickBooks are recorded by the Write Check interface. In this article, the simple steps to record the transactions with images of process flow are described to offer a better guide and understanding. Read the complete article to get all your query resolved, but if still facing problem regarding it then let us know toll-free : +1-855-525-4247

It is a very simple process to record debit card transactions in QuickBooks. The steps to record a debit card transaction in QuickBooks are very equivalent to purchasing a document created with a check.

Simple Steps to record debit card transactions in QuickBooks

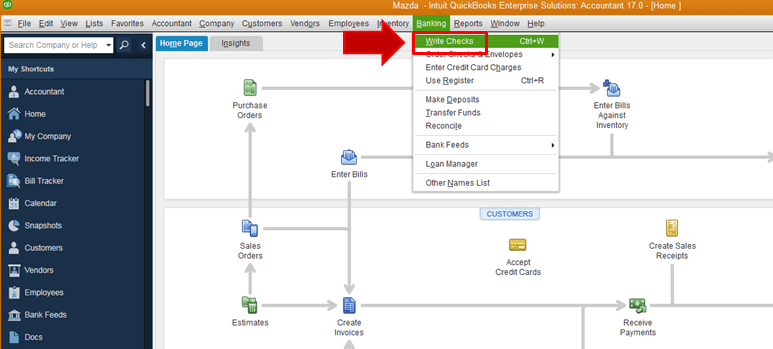

- Start QuickBooks and choose Banking under the toolbar option.

- Under the banking option, select Write Checks.

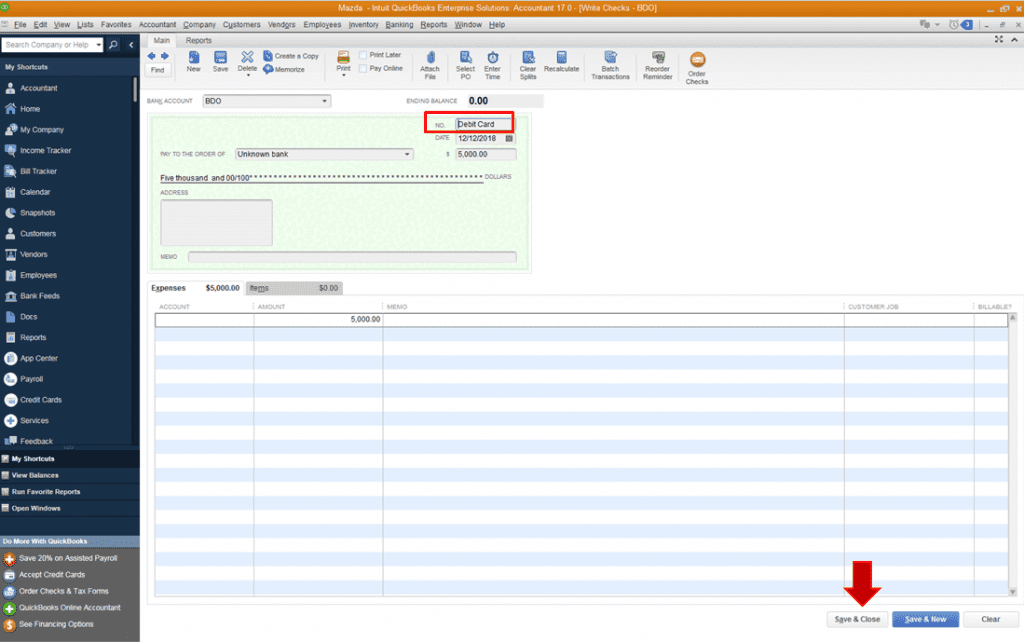

- Unmark the Print Later box.

- Insert code in the check number field that indicates a debit card transaction, like debit. If you want to use more than one debit card, include the bank’s name for the code for different purposes, like Chase Debit or BofA Debit

- Insert the date, recipient, and the total amount of the transaction.

- If you have any additional amount to add like ‘refreshments for the Board Meeting’ then record in the memo field.

- Choose the Save option.

To view the transaction on your register, follow these steps:

- Click the Lists tab at the top menu bar.

- Select Chart of Accounts.

- Double-click the account name.

How to Enter a Debit Card Refund in QuickBooks Desktop

Here we will discuss the simple way of debit card refund in QuickBooks Desktop.

- Open QuickBooks and look for the enter bills. Choose the option that says Credit.

- Insert the seller’s information as usual, with the date of the refund and also the detailed memo line, and the customer/job if appropriate. Record the refund amount (credit amount) and use the account you basically used for the purchase. QuickBooks will calculate sales tax automatically.

- Below the expenses tab, go to a new line. In the accounting field, insert your bank account where you want the refund will appear. Later, tab and enter the total amount of the refund as the negative number. Instantly choose to recalculate and the total in credit amount will be changed to zero. Choose Save and Close.

- The refund amount will now appear in the matching bank account on the right below the deposits and other credits.

How to Enter A Debit Card Refund in QuickBooks Online

The above-discussed steps are for QuickBooks desktops, but they will also work in QBO Essentials or Plus in the same way as you would using a supplier (or vendor if you are in the US).

Another QuickBooks Online method is to use the deposit facility, the deposit includes an area to record GST / HST, unlike Desktop. The only drawback to this method is that this activity does not appear in the supplier transaction list.

Hope, after reading this article you will successfully record debit card transactions in QuickBooks and also easily able to request for debit card refund in QuickBooks Desktop and Online. If you still face any issue or query and seek technical help, then just pick up your phone and call our toll-free+1-855-525-4247 and discuss your problem with our intuit certified ProAdvisor and get instant assistance.