Looking for how to adjust Payroll Liabilities in QuickBooks Desktop? We are here to assist you with a proper solution and you may learn the reasons and much more along with your query. Just read the article and follow the process to get your issue resolved. We hope you can perform the operation of adjusting payroll liabilities in QuickBooks Desktop on your own. Still, having an issue contact our QuickBooks ProAdvisor through Toll-Free: +1-855-525-4247

In order to fix the Year-to-Date (YTD) and Quarter-to-Date (QTD) payroll information of any employee, you are required to adjust payroll liabilities in QuickBooks Desktop. The information that you may need to make adjustments to employee’s additions, contributions, and deductions. You may also need to use the liabilities adjustment feature of the QuickBooks if your payroll liabilities in incorrect somehow.

Tip: We don’t recommend you to adjust payroll liabilities by yourself as it can be a complex procedure. If one is not aware and understanding of the accounting then you should ask your accountant to do it for you. If you don’t have one then you can hire an accountant who can do it.

If you are using either one of the Assisted Payroll or QuickBooks Online Payroll then you need to contact Intuit Customer support to make the adjustment in payroll liabilities, as you won’t be able to do it on your own.

If you are a QuickBooks Standard, Basic, or Enhanced Payroll user then read this full article to learn how to adjust Payroll Liabilities in QuickBooks Desktop.

Why should you use Liability Adjustment?

- If you have set up the wrong Health Insurance Company Contribution with incorrect tax tracking type then you can fix it with liability adjustment.

- With the help of liability adjustment, you can fix the employee’s Year-to-date contribution, deduction, wages, and additions. For those, employees who are not receiving paychecks anymore.

- You can also use this to change the amount for the company contribution items such as 401(k) company match and Health Savings Account (HSA).

Make a Payroll Liability Adjustment

STEP 1: Find Payroll Discrepancies

From here, you’ll know what kind of adjustments you need to make.

- Run a Payroll Checkup. With the help of this tool, you will get to know what problems are affecting your liabilities.

- First of all, scan your payroll data as it will verify your current setup for missing information or any kind of discrepancies.

- You also need to review the payroll item setup, employee records, and wage and tax amounts.

- Along with this, you also need to find the tax amount Discrepancies at a flat tax rate. The tool will also help you in fixing these errors by providing some suggestions.

- Once, your Payroll Checkup is completed, you need to run a Payroll Summary Report for that quarter that you need to adjust. Write down the amount of the Payroll Item or Items that you want to adjust.

STEP 2: Payroll Liabilities Adjustment

- Go to the Employees> Payroll Taxes and Liabilities

- And then Adjust Payroll Liabilities option.

- Now, enter the fields using the tips mentioned below.

- In the Date field, you need to enter the same it is in the last paycheck of the affected quarter. However, if you are working in the current quarter then use today’s date.

- The Effective Date is used to calculate amounts on your Payroll Liability Balance Report as well as the 940 & 941 forms.

- Now make the Employee adjustment and Company Adjustment separately.

- Employee Adjustment: If you are willing to adjust the company paid item then select the Employee Adjustment option. Adjusting this will update the employee’s Year-to-date information of the W-2 forms.

- Company Adjustment: In the Payroll Liability Payroll Report, if you want to remove the balance then you need to select this option.

- Select the Employee.

- With the help of tips mentioned below fill the Taxes and Liabilities Team.

- Item Name: In this select the item that you want to adjust.

- Amount: If you want to increase the amount enter the positive number and to decrease the amount enter a negative number.

- Wage Base: This field is not of use that much. You need to use this if you want to override a tax payment amount on a paycheck.

- Income Tax Subject too: You only need to use this feature when you are making a wage base payment.

- Memo: Here you can add a little description of the adjustment that you made for the future reference.

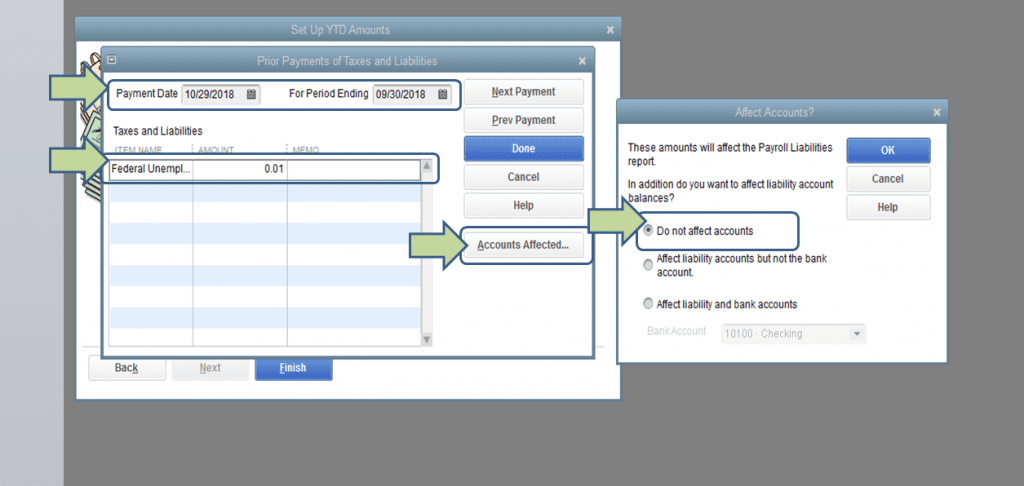

- After that, select the Account Affected option and then OK.

- For the liability and expense accounts, select the Do not affect accounts option so that balances of both of these accounts can remain unchanged. This adjustment will only change the Year-to-Date (YTD) amount on your payroll reports.

- If you want to enter any adjustment transactions to the liability and expense accounts then you need to select the Affect liability and Expense account.

- If required then repeat the entire process again for the other employees too and then select OK.

STEP 3: Now check whether your liabilities are updated or not

To make sure that everything is perfectly fine, you need to run a payroll summary report. Follow the instructions mentioned below to do the same in QuickBooks Desktop.

- From the menu bar at the top, go to the Reports> Employees and Payroll option.

- Here, select the Payroll Summary option.

- Then, appropriately choose a date range.

STEP 4: Correct a Payroll Liability Check (Optional)

You need to correct the liability paycheck before you pay the liabilities. For this, you need to,

- From the top menu bar, go to the Banking option and then select the Use Register option.

- Here, you need to select the register that you use for the payroll and then select OK.

- On the Liability Check right-click on it and then select the Edit Liability Check option.

- After that, go to payroll liabilities and then match the changes after updating it.

- Once finished, select the Save & Close option and then Yes.

The Bottom Line

This is everything you need to know about how to adjust payroll liabilities in QuickBooks Desktop. We have demonstrated the entire procedure for making the adjustment in the payroll liabilities for both the employees as well as the company. We recommend you consult with an expert before making changes in payroll liabilities if you don’t have proper knowledge of accounting. You can have assistance from our Intuit Certified QuickBooks ProAdvisor by calling our 24/7 customer support toll-free number +1-855-525-4247.