In this article, we are going to show you how to void or refund customer payments on QuickBooks Desktop. Reading this might be, useful when if you have mistakenly accepted payment from a customer or unwillingly has to accept the payment from a customer due to any reason. In order to keep your books updated, It is important to void or refund unwanted customer payments. Still, you have an issue that is not resolved then contact our QuickBooks ProAdvisor+1-844-405-0904

When should I void or refund a payment?

If the transaction is still not settled then you can void the payment. QuickBooks keeps the track of all the unsettled and settled payments for you. So if you ever try to void a payment that is already settled, QuickBooks will notify you, then instead of voiding that payment you can refund it or give credit back.

Usually, it is preferable to void the payment instead of refunding them. You will be charged more in fees if you refund the payment. In addition to this, if you refund the customer’s payment then it may take a few days for the customer to get their money back.

Void a Customer Payment

- First of all, you need to sign in to the QuickBooks Desktop.

- From the top menu bar, click on the Customer menu and then select the Customer Center option.

- In the next window, go to the Transactions tab.

- Next, either select the Sales Receipt or Receive Payments option.

- Based on the option, you selected in the last step, you need to select either a receipt or payment.

- After that, click on the Edit menu and then select the Void Sales Receipt option.

- At last, click on the Save & Close option.

QuickBooks doesn’t charge any fee from your debit or credit card for voiding the transactions or customer payments. But, there is a possibility that your customer’s bank may put a hold on the funds. If this ever occurs to any of your customers, then it is advised to them to contact their respective bank in order to remove the hold.

Refund the customer’s payment or give them credit back

Using this QuickBooks feature, you will be able to refund cash payments or checks back to the customer’s credit card account. QuickBooks Payments will take care of the necessary processing if you refund a credit card customer payment. In QuickBooks, you have options to either to refund the entire amount, partial amount, or for any specific product or service.

Things need to do before refunding the credit card payments

First, you’ll need to fulfill the requirements in order to refund the credit card funds.

- Remember, you have to use to same Company Authorization ID or Merchant Account that you used for the original transaction.

- Within the period of 6 months of the original transaction, you have to issue a refund otherwise it won’t work.

- You will have to use the same credit card for the refund that you used for the original transaction.

- Also, make sure that you don’t refund the amount more than the amount that processed on the credit card.

Once you met the above-mentioned criteria you will be ready to refund a payment.

- Open the QuickBooks Desktop software and then sign in to the QuickBooks Payment.

- Go to the menu bar at the top and select the Customers option and then click on Credits Memo/Refunds.

- After that, you need to choose the customer to whom you want to refund from the Customer: Job drop-down menu.

- Choose the product and service against which you want to issue a refund.

- Then, click on the Save and Close button. This will lead you to the Available Credit Window.

- Choose the give a refund option and then OK. Select Retain as an available credit option, if you are willing to give credit for the upcoming future payments, and then select OK.

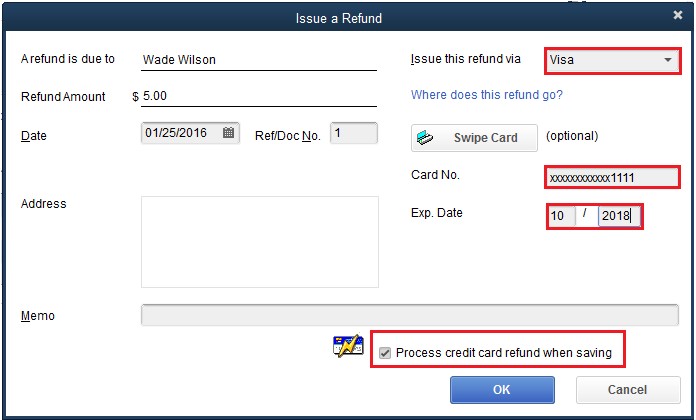

- In the issue of a refund window, at the top right corner of the window, click on the Issue this refund via a drop-down menu and select the method through which you want to refund the transaction. Here, if you are choosing the Cash or Check instead of credit card or debit card then you need to choose an account from which you want to pay the amount.

If you are choosing credit cards for refunding

- Click on the Issue this refund via the drop-down menu, you need to select the credit card type you are going to use such as visa, American express, master card.

- You can either manually enter the credit card information or you can simply click on the swipe card button and then swipe the customer’s card.

- At the bottom right corner of the screen, put a checkmark in the box stating Process Credit Card Refund When Saving.

- Once all the required fields are filled, click on the OK button at the bottom right corner.

After that, you don’t need to do anything QuickBooks will take care of all the process of refund and handles all the accounting for you.

When will the customer get their money back?

As soon as QuickBooks settles your latest batch of transactions at 3:00 PM Pacific Time each day, QB will apply credit and refunds to your customer’s debit or credit card. Depending on your customer bank, it might be some time before your customer is able to see the credit. Usually, it takes 7 to 10 banking days to refund the payment.

Void a Refund or Credit Memo

If you found any issue in a refund or credit that you have given to the customer, or the transaction has not settled for any reason then you have the option to void it.

- From the top menu bar, click on the Customer menu and then select the Customer Center option.

- Find and then open the Customer’s profile.

- After that, you need to find the Credit Card Refund or Credit Memo that you want to refund and then open it.

- Now the Credit Card Refund or Credit Memo window will open, depending on the option you choose in the previous step. Here, select the View Refund Receipt option.

- Select the Void Refund and then OK.

The Bottom Line

We hope that now you can void or refund customer payments in QuickBooks Desktop. In addition to this, we have also discussed the procedure of refund the customer’s payments and give the customer credit back.

If you encounter any error while doing so then you have to worry, simply contact our team of QuickBooks ProAdvisors for an instant QuickBooks payment support. To contact us you can call us at our 24/7 toll-free customer helpline number +1-844-405-0904 for more information.