How do I e-file 1099 with Intuit? What does QuickBooks charge to e-file 1099? Does QuickBooks Online File 1099 Electronically? Are such questions bothering you? If so then take a deep breath because you are going to get answers to all such questions. This article is all about Intuit 1099 E-file service. We will explain what is 1099 form, who needs to pay it, and the complete process of filing it with the IRS from QuickBooks. If you don’t have QuickBooks, check the prices to file the 1099 form with or without a subscription. Meanwhile, you can take help from our QuickBooks ProAdvisor by dialing our toll-free number +1-844-405-0904.

Table of Contents

What is 1099 Form

1099 is a tax form that includes all types of payments made to an individual or business that is not your employee. It files with the Internal Revenue Service (IRS) to track the money paid to the non-employee or contractors in all ways check, cash, or direct deposit. Such payments can be made for freelancers, gambling winnings, rental income, and more. The payer is responsible to fill out the form appropriately and send it to the IRS and contractors.

There are a few forms in IRS but you need to know about 1099-NEC and 1099-MISC.

Do I Need to File a 1099-NEC Form?

If you pay any part-time workers, non-employee compensation, or freelancers more than $600 during the previous year, you’ll need to send them 1099-NEC. Non-employee compensation includes commissions, fees, awards, prizes, and other compensations for the services. Filing 1099 has two benefits it allows the IRS to get the wage information of the contractors and let contractors do their taxes.

There are some conditions listed below. If all the conditions apply, you need to report the payment as non-employee compensation.

- Payments are made to the payee of at least $600 per year.

- Paid to an individual who is not your employee.

- Payment made to an individual, partnership, corporation, or estate.

- Paid for the services for your business.

Do I Need to File a 1099-MISC Form?

The payments made more than $600 in the previous year to the vendors, rent, legal fees, attorneys, and other individuals who are not your proper contractor.

1099 E-File Plans and Pricing

In QuickBooks, you can buy a QuickBooks Payroll subscription or one-time service without a subscription. Look at the information below to know the pricing and services of the plans.

| 1099 E-File Service (Non-Subscription) | QuickBooks Payroll |

| Starting at $12.99 | Starting at $22.50/mo + $4/employee/mo |

| Create and e-file up to 3 forms | E-file unlimited 1099 forms |

| $2.99 for each additional form | Next day direct deposit |

| Every form beyond 20 is free | Digital 1099 copies for contractors |

| Mail 1099 copies to contractors | |

| Manage contractor W-9 tax info | |

| Self-setup of contractor and employee | |

| Automated taxes and full-service payroll |

How to Fill Out 1099 Form

In the 1099 tax form, most of the boxes are self-explanatory, but some users confuse about some boxes. So we are discussing in detail what amount is recorded in each box so you do not make any mistakes for 1099-NEC and 1099-MISC.

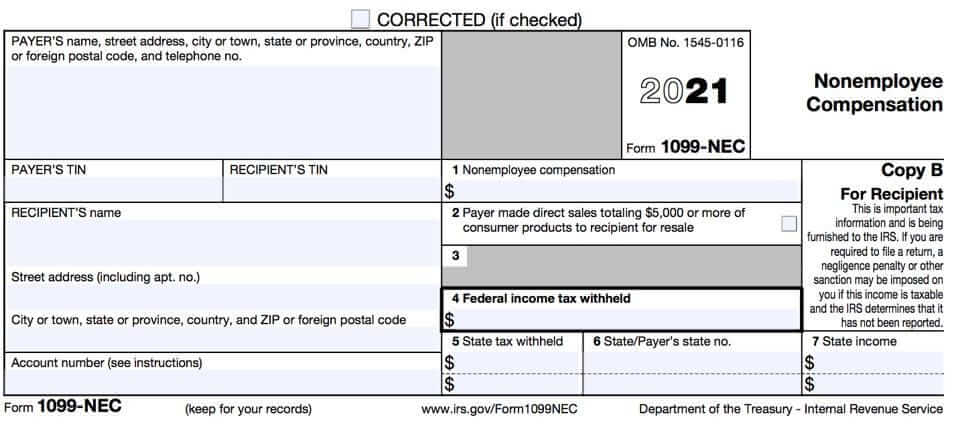

1099-NEC

Fill out each box with the right information. Read the information below:

Box 1- include all the non-employee compensation of $600 or more. It includes fees, commission, prizes, awards, fish purchases for cash, oil and gas payments for the working purpose, and an entertainment facility for a non-employee.

Box 2- Consumer products were sold to you totaling at least $5000 for a buy-sell, resell, deposit commission, or other bases.

Box 3- Reserved for future use

Box 4- Federal tax withheld on non-employee compensation. Enter backup withholding.

Box 5-7- State income tax withheld reporting boxes.

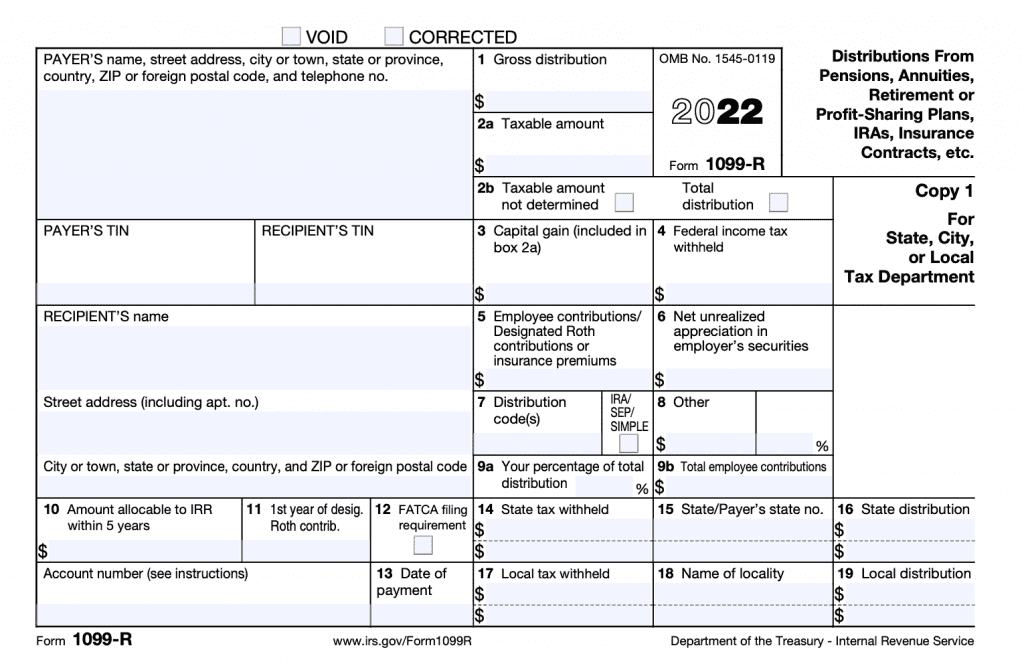

1099-MISC

Box 1- all the rent for your business or other things like equipment rents paid to an individual.

Box 2- Fill in all types of royalties like paid for someone for their property rights. It includes physical and intellectual property rights.

Box 3- If you paid $600 or higher taxable payment to someone and doesn’t fit in any boxes, put it here.

Box 4- Any federal income tax withheld from the amount you entered in box 3 goes here.

Box 5- If you are a fishing boat owner and issue 1099 to a crew member, enter the amount here.

Box 6- If you made a payment of at least $600 to an individual who provided medical or healthcare services, enter the amount here.

Box 7- If you sell the consumer products of $5000 or more to the individual for the reselling purpose, the amount goes here.

Box 8- If you paid at least $10 instead of dividends or tax-exempt interest for borrowed securities, enter the amount here.

Box 9- The insurance company issues a 1099 form to the farmer for the crop insurance payment.

Box 10- Issued 1099 to an attorney for the legal services is greater than $600, the amount goes here.

Box 11- fish purchased for reselling purposes.

Box 12- Section 409A deferrals

Box 13- Enter the amount here if you paid a disqualified person like shareholders or a highly paid person 3 times their typical amount.

Box 14- Amount goes here if you made a payment of at least $600 to a non-employee or independent contractor.

Box 15- If you withheld a state tax from your payments to this contractor.

Box 16- in this box, enter the abbreviated name and identification number of your state.

Box 17- Enter the state payment amount.

E-File 1099 in 2 Steps

Now we will let you know how you can file the 1099 form in 2 easy steps. Follow the steps to know the complete process.

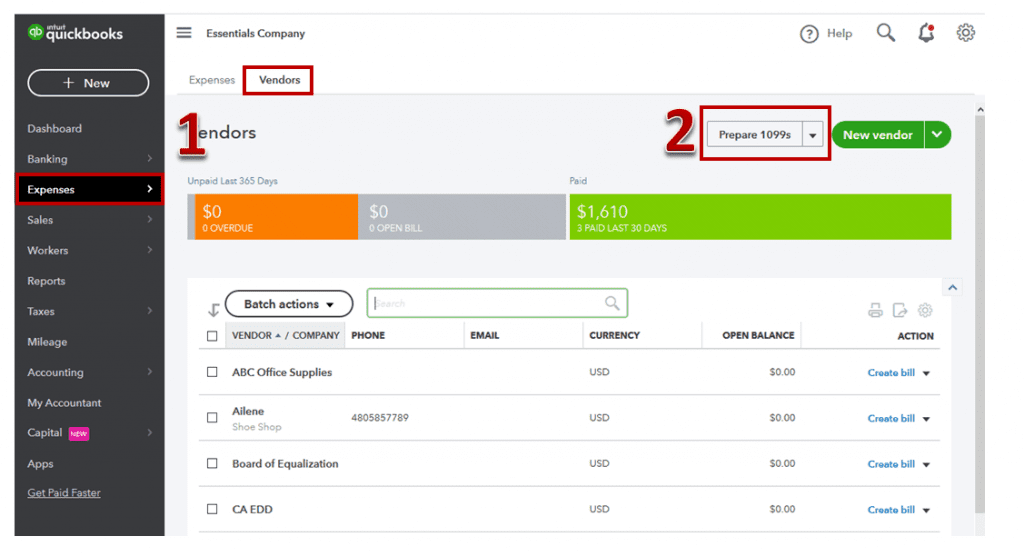

Create 1099 Form

Here’s how you can create and print your 1099 form. You can run the 1099 reports if you want to view what you have paid to contractors. Let’s start creating your 1099.

- Open QuickBooks and go to Contractors or Vendors.

- Click Prepare 1099s and select Let’s get started.

- Make sure that your company name, address, or tax ID is correct and the same as mentioned on letters from the IRS or tax notices.

- Choose the boxes that represent the payment type made to all of your contractors.

- Check all the contractors added, their info is correct, and their email address is correct.

- Review your payment total for every box.

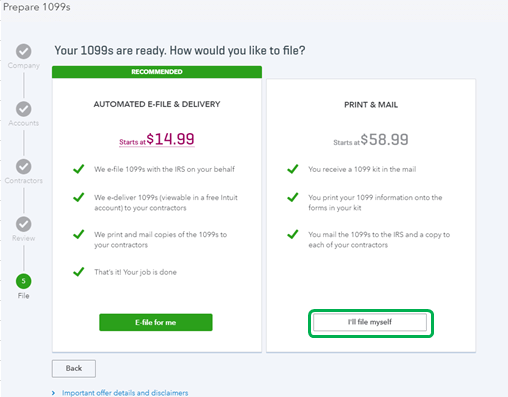

- Click E-File for me to e-file 1099. Or to print and mail the form to yourself, select I’ll file myself.

E-file Your 1099 Form

After preparing your 1099, you’ll need to e-file. Follow the given steps to e-file your 1099 form.

- Open QuickBooks and select the E-File option.

- Verify the 1099 form and click Continue.

- Follow the on-screen instructions to complete the 1099 e-file. You may be asked for entering your billing info. You can review the contractor’s 1099.

Check Your Filing Status

Once you file your 1099 with the IRS, QuickBooks will notify you about the filing status through email. You can also check it yourself with the following steps.

- Open QuickBooks.

- Go to the Payroll tax, then 1099 filings.

- Click View 1099 to view a PDF copy.

Now you are ready to go ahead with the 1099 form. We explained the complete process in detail, so you don’t get stuck in any step. If you find any issue in the process or have another query regarding QuickBooks, get support from our QuickBooks ProAdvisor. Our well-trained and skilled experts can solve your query instantly. Feel free to dial the toll-free number +1-844-405-0904.