Quicken Rental Property Manager software provides all the tools a landlord needs in order to handle business as well as personal finances efficiently. In this article, you’ll get to know the use and benefits of Quicken for rental property management. Go through the article to learn all the stuff related to Quicken rental property manager, the details are arranged in order to deliver you exact verified information. You can also call our toll-free Quicken support number:+1-844-405-0904

Here is how to get started

- Add an account to collect rent: if you don’t have an account in Quicken this account should be a checking saving or cash account.

- Add a property: to track in Quicken. Link the property to a Quicken house account.

- Include a tenant: assign the tenant to property or unit.

- Import: your retail property manager v2 data to Quicken.

This feature requires Quicken rental property manager, Learn how you can upgrade Quicken in a few minutes.

Table of Contents

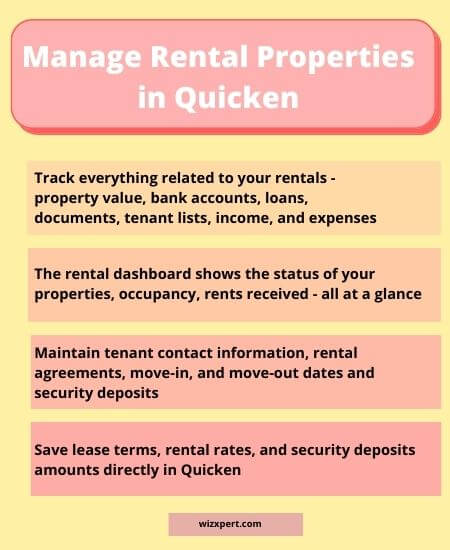

Benefits of Quicken Rental Property Manager

Calculate your Net Worth

Here the key to managing multiple properties is monitoring each unit in the rental business. The best thing about Quicken’s Rental Property Manager is that it helps in storing data on each unit. Whether it’s a unit in a multifamily building or a stand-alone residence. Whatever be the value of rental properties you own it simply contributes to your net worth like other personal property. So, in a way, Quicken Rental Property Manager offers the option to track this aspect of your assets. There is no need to worry about the rent collection up and running quickly. You can also add value tracking at a later date.

Stay on top of Rent collection

In order to monitor upcoming, paid, and overdue rent payments, Quicken uses the Rent Center feature.

As the Rent Center sorts properties, units, and tenants so you can select any of these to enter a rent payment. In that case, when Quicken isn’t sure where to assign a transaction then it indicates an unknown property or tenant which permits quick identification of data entry errors. In this way, no more rent is credited to the wrong residence.

Manage Rental Expenses

Keeping costs down and income up ensures business success. Although it’s fundamental, tracking the money you spend and allocating it to each residence. Therefore, it can be a complex task without software to assist you. The rental property manager also sorts expenses by the unit for easy comparison against rent revenues.

Income and expense graphs give permission for visual comparisons of earnings for each unit.

Track Tenant Details

QRPM helps in storing crucial data that you need to keep track of your tenants. And also it helps in managing the information such as:

- Rent collection reminders

- Occupants who reside in the rental unit apart from the tenant.

- Personal information of the tenant’s

- Lease start and end dates.

- Move-in and move-out dates, if it is different from the lease dates.

Additionally, Quicken rental property manager also manages security deposit details, tracking payments and refunds in a liability account and then factors these amounts into your net worth personal calculations.

Analyze Rental Unit Performance

Quicken simply shines on the Profit/Loss page which gives a snapshot of your current monthly situation. In addition to transactions that have already been entered, the page shows expenses and scheduled rent not yet received, so your analysis is not delayed by a paper check in the mail. The software helps in calculating data such as projected profits, last month’s performance and any changes in the In/Out/Profit/Loss snapshot.

Prepare for tax season

You’ll find current expenses such as replacing parts of a leaky faucet, are deducted from rental income in the tax year they occur. Therefore, capital costs simply increase the value of the property or investment in the business. That thing such as replacing a roof or upgrading office equipment are depreciated over several years. It tracks and sorts these expenses and exports the data for use with tax preparation software. In some cases, the software reads Quicken data directly by the tax app. And thus, it helps in eliminating the need to run summary reports.

Synchronize your Data

With access to your budget in Quicken, credit card balances and bank account, the Quicken mobile app, which is included with Rental Property Manager then becomes a valuable tool for on-the-go management of your rental business. The Portfolio X-Ray feature easily tracks investments and permits viewing of component stocks within investment funds. It imports data from bank accounts and other Quicken versions very easily. Text and email alerts will remind you of upcoming bills. And snap-and-store receipt provides support in keeping you on top of record keeping.

Include personal finances

The rental property manager in Quicken provides you access to Quicken’s personal finance modules such as banking, investment, and credit card account management. And in this way, all your accounts and rental business data are accessible within one program.

And current versions of the software package simply includes free access to credit scores and mobile apps.

How you can add a rental property?

At first, you need to inform Quicken about the rental property that you own. You are given the option to add a rental property as a single unit or multi-unit property in Quicken. And you can name the property and its units. If you want then you can also associate the rental property to a house account. In case you have already added a house account then you can link the existing house account with the rental property.

Moreover, the information about your rental property in order to group together your rental transactions is used by Quicken. Quicken can easily display the income and expense transactions for your rental property. In order to display the income, expenses charges, and tax deductions by the rental property, you just need to simply add a separate rental property in Quicken for each real-world rental property.

- Firstly, click the Rental Property tab.

- Next, you need to click the Properties & Tenants button and choose Add Property.

- After that enter the name, tag, and address for the property you own.

What’s a rental property tag?

You need to select the appropriate option:

- At first, click Single unit property if this is a single unit property.

- Now, click Multi-unit property if this is a multi-unit property.

What is a multi-unit property?

When you divide your property into units is termed as multi-unit property. And, this unit can be a floor, an apartment, or even a room. Let’s take an example; in an apartment, you can consider each room as a separate unit. Or also in a duplex property, if you want then you can consider each floor as a separate unit.

And, in Quicken, a multi-unit property must have at least one unit.

Why is the property name important?

Well, it is important because it is a label for the property. By property name you can easily claim that it is your property. And, when you enter transactions for the property, Quicken uses the property name in the Rent Center snapshots, the Tax Planner, the Tax Schedule Report, and the Schedule E report.

Let’s understand with an example;

Suppose you refer to your property at 500 Mayfair Park, as ‘Mayfair’, enter property name as Mayfair.

How to add units in a multi-unit property?

- You need to enter a unit name or unit number for each unit in the property.

- Next, click Add more units to add more units, and this is optional.

- In Quicken, a multi-unit property must have at least one unit.

- Now, identify whether you want to track the value of the property.

How does this help you?

Although Rental Property is an asset that contributes to your net worth. If you fill this section whenever you create a property then Quicken creates a virtual house account. And that comes with the opening balance equal to the approximate value of the property.

Now, just go to the Track Value of Rental Property, select the appropriate option:

- After that, you need to click Yes, I want to track the value of this rental property in order to create a new house account to link with the property. Just fill in the approximate value of the property.

- Next, click Yes, I am tracking the value of this rental property. If you are already tracking the value of the property using a house account.

- Now, click No, I will do this later to decide later. If you want then you can always return to the Edit Properties dialog to enter more of your information later.

- After that click OK.

Point to remember:

In order to add a property or unit, you can also click Properties & Tenants and then click Add property. Just be sure the house account name should be identical to the property name. In case you change the property name, Quicken changes the house account name. And when you add the rental property tag to your transactions then Quicken will provide you various ways to review your rental property data.

As we have discussed above the Quicken Rental property manager in Quicken. Also, you’ll get to know about how to add a rental property in Quicken. Hope this information will help you solve your queries related to rental property.

For further assistance, you can contact our Support team. Dial our toll-free number +1-844-405-0904 in order to get help from our customer support team.