QuickBooks Online bank reconciliation means syncing your bank account and credit card account details with QuickBooks Online. This is very important for you to know how to reconcile the account in QuickBooks Online. Since it will help you to keep track of how much you have earned and spent. This article is to provide you all the details and information you need, so read the article and stay with us for more details about the reconciliation process, report, reconciliation Discrepancies, etc. If you have any query then contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

And it is important that the ending balance of the previous month should match the starting balance of the next month. You should reconcile your bank account monthly almost at the same time when your monthly bank statement is issued.

Table of Contents

What is Quickbooks Bank Reconciliation?

It is a process of matching data entered by you in QB with the physical data that clears your account. If you miss any entry while entering data into the software it can cause great damage to your whole accounting system.

So, it is very important for us to catch the missing entry. This is the reason why Many small business holders use the running bank account balance feature in the QuickBooks software which catches every missing entry.

Reconciliation is extremely suggested to be done on daily basis. So, that all the discrepancies between your record and bank record can be resolved.

There might be a question that comes to your mind how do I reconcile in Quickbooks Online? Don’t worry about it, You can easily reconcile accounts in QBO. When you reconcile with your bank account, your account gives most of the information related to transactions. You add your oldest bank statement that has not been reconciled and you will compare the monthly bank statement with the registered transactions within QuickBooks and that difference between them should be ZERO! Now reconcile process is complete.

You should match each of the deposits in your report to those eminent on the bank statement. If you have listed a deposit that the bank had not yet collected concurrently with an activity the month, list this deposit as a piece of reconciling information that should be added to the bank’s ending cash balance for your account.

Is it important to reconcile account in QuickBooks Online?

Your financial reports will not worth anything if balances in QuickBooks are not matched with your bank and credit card statements. At the end of the financial year when you file tax returns reconciling your account will help in process it precisely with ease.

Another reason is that you’ll be always aware of the funds you have in your account and helps you in taking better decisions regarding your business.

Advantages of Quickbooks Bank Reconciliation Online

QuickBooks can identify future transactions and save your time and effort in the long run. You will benefit from these QuickBooks bank reconciliation feature:

- It syncs automatically with one – or multiple bank accounts

- It will automatically take your records and sorts them into sections according to your suitability

- Gives you the possibility to disappear any transactions that are not fully completed

- Ignores any transactions that have not cleared the bank

- Matches transactions to your bank statement transactions.

How to reconcile an account in QuickBooks Online?

Step 1: Review your Opening balance

If you don’t know about reconciliation or if this is your first time reconciling a bank account, you must review your opening balance. You can match the live transactions of your bank account with this approach. The important thing for you is that, it can save the process by connecting your bank and credit cards to online banking. It automatically downloads all the transactions and notes the opening balance for you in QuickBooks.

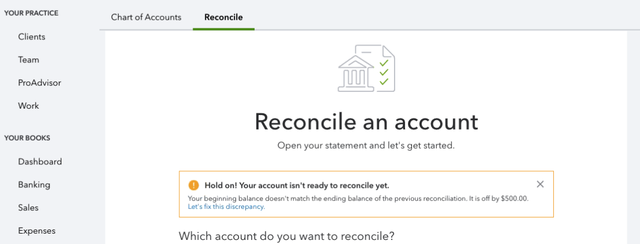

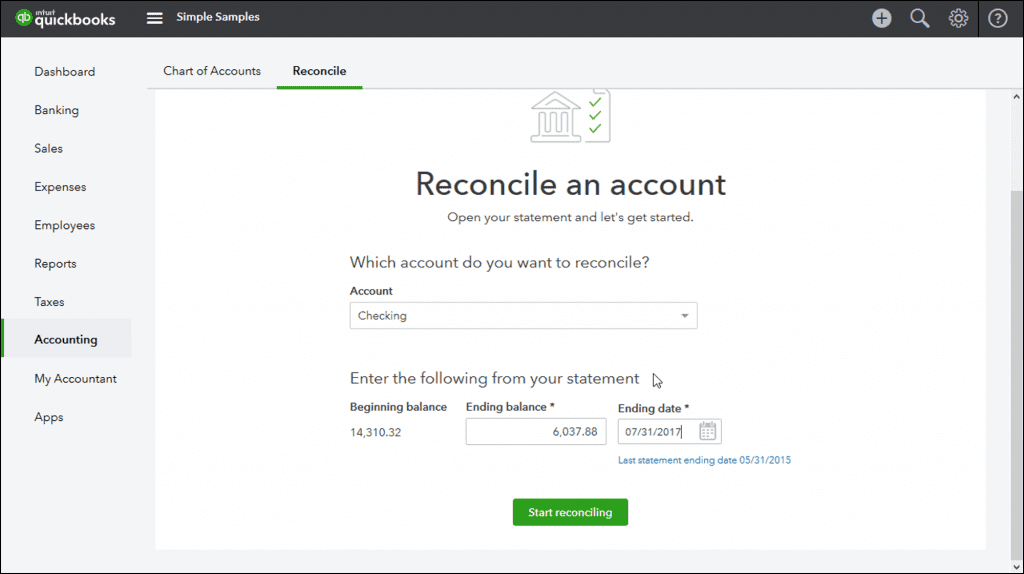

Step 2: Start a reconciliation

Start the QuickBooks reconciliation after getting all the monthly bank or credit card statements. Ensure that, if you do regularly reconciliation so, you have to make one statement at once. Follow the steps for further details:

- You have to ensure that you match all the records of transactions if your accounts are connected with online banking.

- You have to navigate to the settings tab and then reconcile, but if you beginner then you have to click on the Get Started option.

- Find the Account dropdown menu and choose the appropriate account that you want to reconcile.

Note: You have to fix the previous reconciliation if that occurs from the We can help you fix it option.

- Now, review the beginning balance and ensure that the balance matches one of your statements.

- You should enter the new balance and the new date on your statement. A couple of banks call the ending balance a new balance.

Important: When you reconcile this account, you have to check the statement ending date, ensuring you’re reconciling the following month’s statement.

- If you need to, you can review the Last statement ending date. After a day you can see your current bank statement.

- After that, click on the Start reconciling.

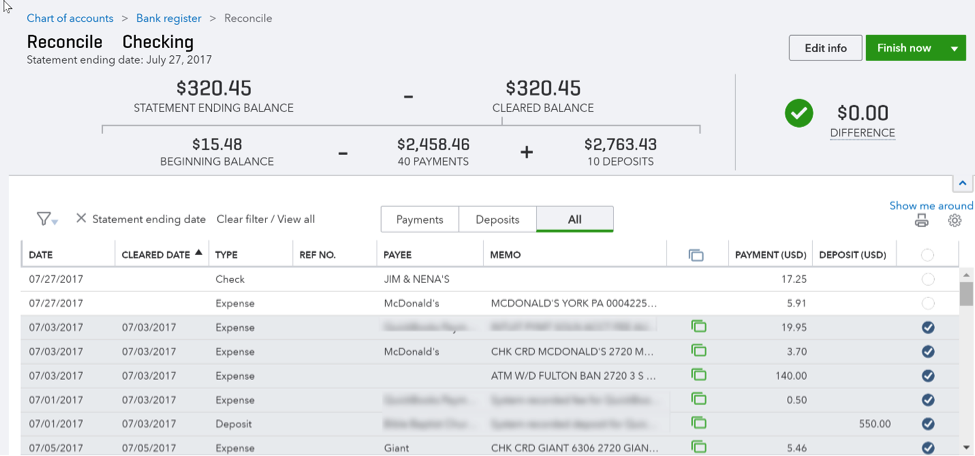

Step 3: Compare your statement with QuickBooks

If you want to compare bank transactions on the statement in QuickBooks you have to review them one by one. After completing the process correctly, the difference amount must be ‘0’. For executing the next step, ensure that you have the right dates and transactions in QuickBooks.

Reconcile accounts connected to online banking

- Start with the first transaction.

- Review for the same transaction in the reconciliation.

- After that, compare the two transactions. If you tally the amounts, place a Checkmark next to the related entries in QuickBooks. This marks the transactions as reconciled.

- To save time, QuickBooks selects the transactions you added from online banking for you.

- Do not put the checkmark if the transaction statement does not show up.

- And must compare each transaction’s statement with the QuickBooks.

Note: If you’re sure that you have found a match but notice a small difference, such as the payee. Then you can expand the view of the transaction in QuickBooks by selecting it and clicking on edit. Make the necessary edits to ensure the details tally.

- At the end of the process click on the Finish tab if the difference b/w the statement and QuickBooks is $0.00.

Additional Steps to Review Past Reconciliations

To review the statement you have to run QuickBooks reconciliation.

- Navigate to the Settings tab and then click on Reconcile.

- Now, choose History by Account.

- After that, find dropdown menus and choose the account and date range.

- You can print or export reconciliation reports if you need to share them.

Edit completed reconciliations

You have to be careful during the editing of past reconciliations because it can unbalance your accounts or other reconciliations. It can work as a blockage of your future reconciliation. You can review your past reconciliation if you make any transaction reconciliation transactions wrongly.

Reconciliation Report

A QuickBooks Bank Reconciliation report is a self-generated report by QuickBooks Online after the end of the reconciliation process. You can use this report to analyze your business financials and also the report provides a brief about the beginning and ending balance of the month. You can also see the cleared and the uncleared transactions from that month.

How can I view the Reconciliation Report

These are the steps for viewing your reconciliation report.

- From the left side panel select ‘Reports’.

- Then in a search bar type and select ‘Reconciliation Report’.

- Select the account for which you want to view a reconciliation report.

- In the drop-down menu mention the time period.

- Finally, you can see the report.

Reconciliation Discrepancies

This happens when the difference of amount between the QuickBooks Online account and the bank statement is not zero.

If there is a difference in the opening account balance then the reason could be that previously reconciled files have been deleted, modified or any new file has been added.

Other reasons behind this could be like some extra charges bank applied, you entered some checks in QuickBooks but your bank still not cleared those checks, you forget to feed those transactions in QuickBooks that your bank posted. These are some anomalies due to which there is variation in the amount.

You can avoid these roadblocks by simply adding these transactions in QuickBooks Online as soon as it happened.

Frequently Asked Questions

How to Unreconcile an Account in QuickBooks Online?

When your QuickBooks balance doesn’t match with your bank account statement sometimes it is necessary to unreconciled that account. For this first, you need to go to Banking Menu and then Registers. After that select the account from the Drop-Down menu. Then select the transaction you want to reconcile and click on “R” at the top. Your transaction will be unreconciled.

How frequently should I reconcile the account in QuickBooks?

You should at least reconcile your account once every month. Best time is when you received your monthly bank statement or credit card statement.

As we discussed above reconcile accounts in QuickBooks Online is a very helpful exercise to perform at least on a monthly basis. But we know sometimes it comes out to be slightly difficult for some users to execute it perfectly. Therefore, we offer you our service QuickBooks ProAdvisor in which certified experts will provide you an instant solution to your problem.

Get in touch with us, call us at our Toll-Free number +1-844-405-0904.