If you are looking for how to record and allocate prepaid expenses in Quickbooks? Then your tour is complete for the solution to this question. Here in this article, we are going to deliver you all the information related to record and allocate prepaid expenses in QuickBooks. All the related data and solution is available in this article. If not able to get any of them or want to be answered your query, then get in touch with us+1-844-405-0904.

But before that do you know what prepaid expenses are? No! Don’t worry prepaid expenses mean when you have to make expenses when the year starts but the benefit or say profit will come out from it when the year ends or some years later.

We can take a good example of it if the businessman has to make expenses on his business when the year begins and he gets his prepaid expenses profit after this year. Or some other example like insurance. When you are going to take insurance for your car, bike, family, etc. so you have to pay something at the beginning. And you will get the value of this after some years. In simple words, prepaid expenses mean that you have to pay before taking that product or service.

Let’s say you take the car insurance and you pay $1000 to the company. And you pay that in the first month of the year. So that your coverage of insurance remains throughout the year. When you create your first month’s financial report then show the entire cash outlay of your insurance, there’s a chance that it can reduce the profit for that month and can make the financial result very bad than before.

So you have to record all the expenses as prepaid expenses assets. It’s very important to record all the prepaid expenses because you have already paid for that service or product. And you don’t want to forget to take it. But where you will record it? For this, you can make a journal entry for prepaid expenses.

With the help of accounting software, you can easily create a journal entry. There is an accounting software named QuickBooks. But if you don’t know how to use this accounting software. Don’t worry you can also hire an accountant. It is recommended that if you don’t know how to do an accountant you should hire someone or talk with the specialist.

So now we will learn how to create the journal entry to keep our prepaid expenses records. First, we will learn how to create records in windows, and then we will learn how to create records in mac.

QuickBooks Desktop For Windows

1. For tracking the prepaid expense you need to make an account.

- Go to the company menu and choose the options chart of the account.

- Now you redirected in the accounts window chart. Don’t move anywhere just right-click where you are and then click on new.

- Go to the choose account type window. There is a dropdown of other account types under it click on other current assets.

- click on continue.

- Now you will see a form under this form it will ask for some details about you like your account name (Eg. prepaid expenses). And more details after filling in all the details click on save and continue.

2. Now you need to enter a payment to the vendor using the account that you have created in step 1.

3. After all, make a journal entry that is memorable. So you can allocate for a month or expenses quarter.

- First, go to the menu of the QuickBooks company. Now you need to choose the general journal entries.

- Then type the date of the first period appropriately. Here you have a right for using your own entry number. Or you can also allow QuickBooks to auto-assign one.

- Now you have to debit your account of expenses and credit your prepaid expenses for making the percentage of total payment appropriate. And include your memo if you want.

- To memorize the transactions first click on CTRL and then click on M. Now give it a name that will be memorable for you. And click on automatically enter. Now choose how much you want the entry recorded and the date of the next transaction. And indicate the numbers how many entries left.

- Next click on ok.

4. The entries will record on the basis of the frequency you have chosen, decreasing the prepaid expenses account every period. The balance which is available in the account of prepaid expenses should be NIL at the coverage period ends.

5. But if the user is tracking the account and there are multiple prepaid accounts. It is recommended to the user that they need to make sub-accounts of the prepaid expenses so they can track each account properly.

So this is the overall process by which you can create the records in the windows. Follow these steps properly for recording expenses in the windows.

How to Record and allocate Prepaid Expenses

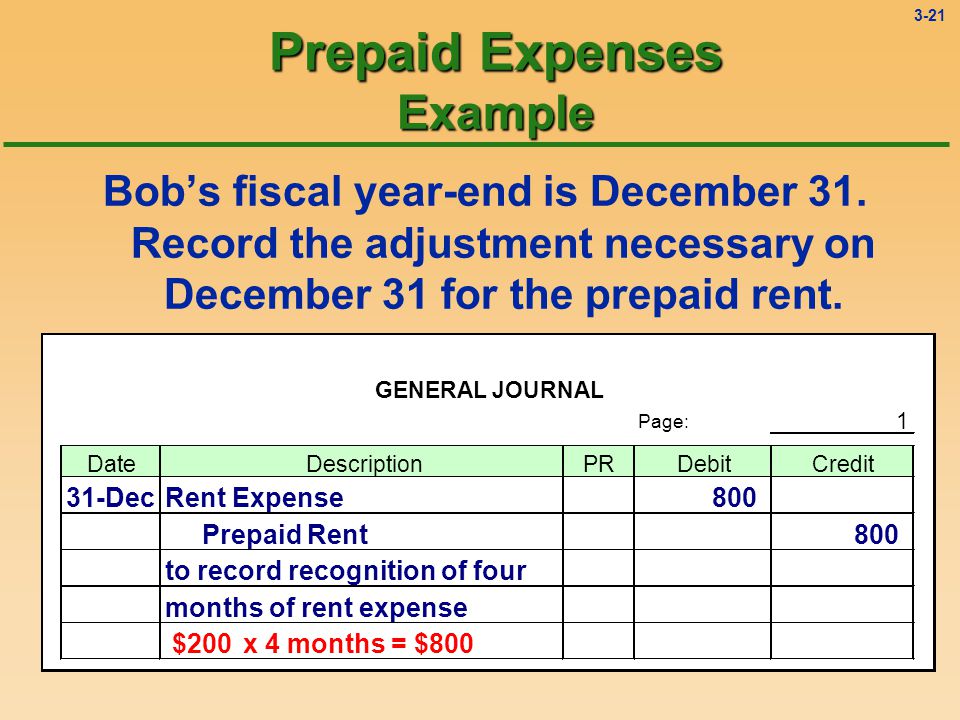

Journal entry of prepaid expenses helps us to keep our accounting books accurate. Now let’s see an example of a journal entry.

Example 1

Let’s suppose you take an insurance policy for your business or company for one year of $2000. You pay for the entire year and use insurance.

Whenever you go to buy insurance, debit the prepaid expense account for showing that the asset is increasing, And also credit the account of cash for showing that the cash is decreasing.

| Date | Account | Notes | Debit | Credit |

| 1/1/20XX | Prepaid Expense | 2000 | ||

| Cash | 2000 |

But remember you have to adjust the account every month by the policy you are using. Suppose the policy you are using is for the last 10 months so divide the cost by the 10 months that is 2000/10 is 200. This means you need to adjust the account by $200 every month.

Now there’s an expense of $200 with a debit of insurance. And now decrease the prepaid expense account by the credit. Then redo this process, again and again, every month unless the policy is completely used and the account of the asset is zero.

| Date | Account | Notes | Debit | Credit |

| 1/1/20XX | Prepaid Expense | 200 | ||

| Cash | 200 |

Till now we learn how to keep records in windows. Now let’s see how we can keep this record in the mac.

QuickBooks Desktop For MAC

- For tracking the prepaid expense you need to make an account.

- First, choose the list and select the chart of accountants. If you want to create a new account then click on the + icon.

- Now you will redirect to the New window of the account, In the type, menu choose another current asset.

- Provide an account number if you are using and name( prepaid expenses) also.

2. Now you need to enter a payment to the vendor using the account that you have created in step 1.

3. After all, make a journal entry that is memorable. So you can allocate for a month or expenses quarter.

- First, go to the menu of the QuickBooks company. Now you need to choose the general journal entries.

- Then type the date of the first period appropriately. Here you have a right for using your own entry number. Or you can also allow QuickBooks to auto-assign one.

- Now you have to debit your account of expenses and credit your prepaid expenses for making the percentage of total payment appropriate. And you can also include your memo if you want.

- Then in the edit, now choose to memorize a general journal entry. Now give it a name that will memorable for you. And click on automatically enter. Now choose how frequently you want entry to be recorded and the date of the next transaction. And indicate the number of entries left.

- Choose OK.

The entries will record on the basis of the frequency you have chosen, decreasing the prepaid expenses account every period. The balance which is available in the account of prepaid expenses should be NIL at the coverage period ends.

5. But if the user is tracking the account and there are multiple prepaid accounts. It is recommended to the user that they need to make sub-accounts of the prepaid expenses so they can track each account individually and separately.