First of all, you need to know what actually the cash crunch is and how it comes. When an organization does not have money to operate its own business successfully or in a normal way, this situation is simply called a cash crunch. In this article, we have discussed in detail how to manage and survive a cash crunch with QB financing apps. To know the details and learn the way to survive a cash crunch go through the article, and get your query resolved. If you have any queries or need help contact QuickBooks ProAdvisor toll-free: +1-844-405-0904

As we know well, cash is the initial need of any business, but when you need the cash to extend your business cash flow is down, or face a cash crunch. Then your business becomes cash-challenged and some reason also responsible for cash crunch such as a volatile sales cycle, longer Account Receivable cycles, and feeding the needs of a fast-growing business.

Short-term cash crunch for any small business is the most challenging time because of the fast-growing business slowdown at that time and due to this reason, we suffer some other issues related to business.

The key to surviving the crunch in business is using a small business loan. Invoice factoring is the best way to take out a short-term small business loan, a line of credit, or other types of financing. Now surely one question arises in your mind what is invoice factoring for business and how do we use it? It helps when you need or you waiting for funding, for example, if a customer pays slowly and your business has large outstanding invoices or receivables that time factoring can provide you with the funding. QuickBooks Financing apps help overcome the chance of a cash crunch.

A personal line of credit or business line of credit are similar such as a credit card or home equity line of credit but one thing is different those funds are used for business purposes.

Table of Contents

Reasons behind the Cash Crunch

Cash flow helps keep your business operating as well as increase your turnover. You’ll need cash for paying some bills like paying your vendors, paying your office expenses, for payroll, etc. But many reasons may affect your cash flows some are the common factors like recessions, macroeconomic issues, natural disasters, and wars. But some are the other factors depending on the business decisions and performance that follow:

- You should have enough cash that help in case of a decline in revenue so for operating a sound business you need to have cash reserves of at least six months that protect your business.

- Without proper sales planning and making offers and discount schemes, the sales team gives discounts from the profit margins to complete the target which may cause to reduction in the cash flow.

- If your business has a lot of outstanding receivables then you need to send a payment request to your customers otherwise it also leaves your business in a poor condition.

- If there is a seasonal fluctuation in demand then your sales may go down and you’ll be in a low cash flow situation. In this situation, you need to monitor your inventory also.

- If your business has expensive borrowings and with high interest rate then most of your cash will go into repayments.

- If your business is growing then it is complex to get the exact cash flow and difficult to forecast what is needed in the future you need a professional accountant who looks at your cash flow history and then forecasts according to it. Otherwise, it may loosen up your cash flow.

Invoice Factoring in QuickBooks

Invoice factoring is also known as ‘factoring’, or ‘date factoring’. It is a financial product that allows businesses to sell due invoices like accounts receivable to a third-party factoring company. The factoring company gets an invoice for one percent of its entire value and then adopts the accountability for managing the invoice payment.

Invoice factoring is a kind of account receivable finance. It is intended to assist in providing working capital for businesses that experience long payment terms with invoices. It is a frequently common form of alternative trade financing. This type of alternative finance has increased in popularity as it also becomes more challenging for businesses with incomplete loans to use conventional finance goods from high street banks.

How Invoice Factoring Works?

Factoring businesses mostly pay in two sections, the first covers the amount of the receivables (meeting your immediate cash-flow requirement) and the remaining subtracting any factoring charges when your client settles his invoice. The primary steps are as follows:

- You submit the details of your invoice to determine whether you are eligible for the factoring facility. The invoice factoring company will then evaluate how dangerous the loan is (it is industry-specific, as well as about your particular customers) and will give you your quote.

- Once the agreement is reached, the factor will pay you the amount in advance.

- The factor will start collecting invoices with your customers

- Once the invoice is submitted, the factor will pay you the balance of your money, deducting their fee.

How to Deal Cash Crunch with QuickBooks Funding Apps?

QuickBooks Online helps to resolve this problem by connecting the apps with QuickBooks Online and managing the small business. BlueVine, Fundbox, and QuickBooks Financing are small business financial apps.

For better understanding you download these apps and sync with QuickBooks Online the App will use your QuickBooks data to give you information about financing such as whether your business qualifies for financing and what your credit limit is.

Apps have multiple funding options, the providers will tell you which of their funding products are available to you. These apps suggest more traditional small loans or help demystify invoice financing and start-up loans.

Before you download these apps, First you connect with QuickBooks online or Create an account in QuickBooks online and data should be up to date. Fulfill the business criteria with each provider and understand the terms of the loan product before you commit. Check the best suitable option in apps and get more knowledge of apps then you start work on it. Here we discuss the three apps of small financing businesses.

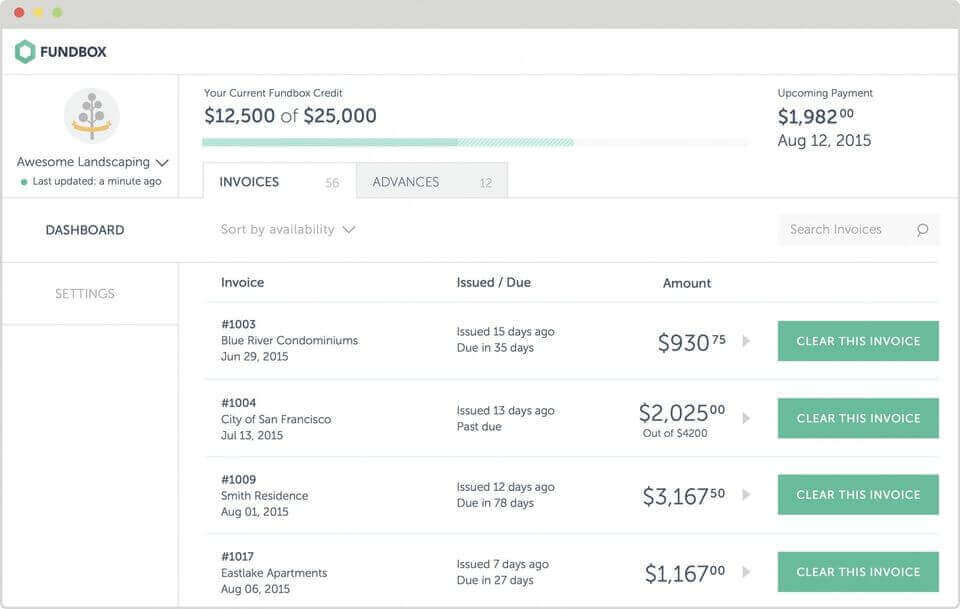

Fundbox

Fundbox provides the flexible funding you need to grow and a common-sense line of credit that gives a small business. It doesn’t take more time to connect in minutes with Quickbooks accounts.

Once a QuickBooks account connects with Fundbox, get a funding decision in hours and get funds as soon as the next business day if approved, After approving a fund, now your Fundbox dashboard shows the full list of your QuickBooks invoices. Now you are free to choose the ones you want to advance with your Fundbox credit, all from within your QuickBooks account.

All business users pay a fee of the fund box weekly or pay a flat and pay the full amount of their advance at any time.

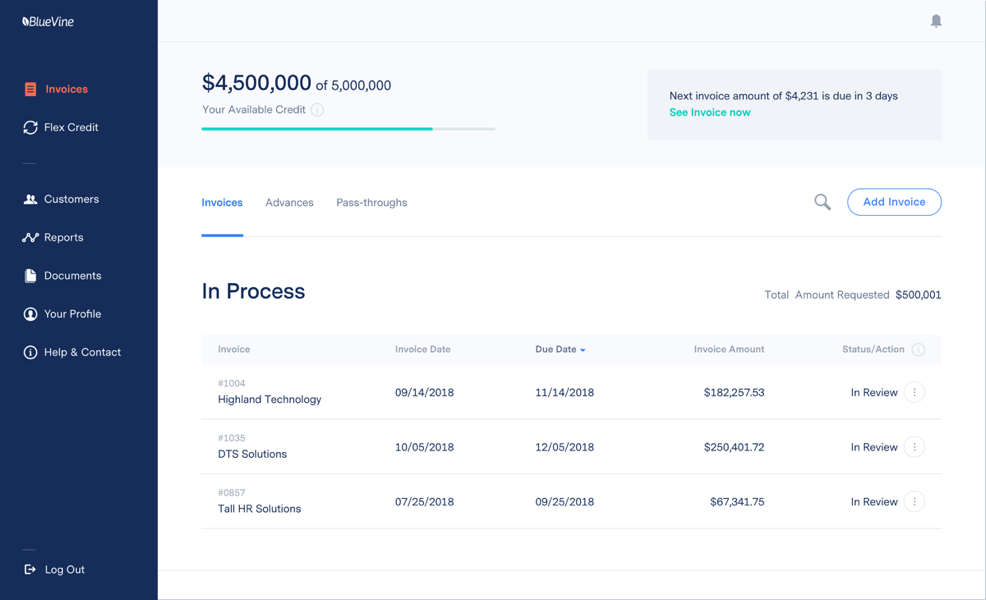

BlueVine

If you want fast funding for your business you use the BlueVine app.

BlueVine provides two options for small business

- Factoring

- Credit lines

Some features of the BlueVine app:

- First, you apply online, it connects in less than 10 minutes, approved in as fast as 24 hours.

- Submit your invoice or automatically sync with the QuickBooks account and upload invoices to your dashboard.

- One feature of BlueVine provides the money upfront and the rest fees directly minus BluVine’s fees, once the invoice is paid.

- Many people depend on BlueVine because they feel secure with this.

- It sets up a bank account and P.O.Box in your business name and you will receive payment directly from your client. BlueVine Factoring Offering approved $2.5 million for customers and you can be paid as soon as 48 hours in most cases.

- For QuickBooks customers, the standard current rate is 5-6 percent per week, with a minimum of one week.

- The BlueVine line of credit gets approved in as fast as 20 minutes. BlueVine dashboard helps you request funds Draw funds and get the amount in your bank cash account within hours.

- Payback each draw with fixed monthly or weekly payments over 6 or 12 months.

- The line of credit is available when you need it or you have a cash crunch. BlueVine also offers credit lines up to $100,000 in equal or monthly payments.

QuickBooks Financing

QuickBooks Financing app allows you to discover intelligent financing options for your business, with term loans, credit lines, inventory financing, small business management loans, and many more. This is a market where you can seek out proposals from a variety of hand-picked partners to do the best job for your individual business requirements.

Once you log in and start the application, you can see what options are eligible for all of you without affecting your own credit score. QuickBooks makes it easy for you to analyze rates and conditions, so you know all the costs

QuickBooks Financing has smart financing options

- Term loans

- Invoicing financing

- Lines of credit

- Small business Administration loans and more

Other ways to survive Cash Flow Crunch

- If your business is in a cash crunch situation then the first step you need to take is to delay the payments. You should extend the due payments of some of the suppliers and vendors with negotiation. If you have a healthy relationship with them and a track record of on-time payments then they can manage with you.

- Cut your non-essential expenses if your sales are down then you can reduce the number of stuff-loading vehicles, and you can reduce the inventory cost by stopping the orders from vendors and dropping the recurring subscriptions.

- It is so irritating when you have a cash shortage in this situation you can give reminder calls if you have outstanding receivables. This can help you a lot in increasing your cash. You can motivate your customers by giving some of the extra cash discounts.

- Try to get discounts from the vendors too for ourselves. You can ask the suppliers and vendors for purchasing discounts. It helps a lot in cash flow so that you can give extra discounts to your customers to increase turnover.

- Last but not least you can go for small loans or a Line of credit from financial institutions for working capital. But you need to consider the interest rate and the fees imposed by the institutions.

In the above-discussed blog, you can find all solutions in one place, it offers a better opportunity to deal with the cash crunch in your business. We personally recommend the QuickBooks Financing app because it is very easy to use and offers you more functionality than the other two apps. In the QuickBooks Financing app, you just need to log in to the app and need to search for the best suitable option. Fulfill the criteria of the business and take permission and after approval, you will get funded in as little as 24 hours. It supports you when you suffer from a cash crunch and maintains your business gap. BlueVine and Fundbox are not Intuit offerings but QuickBooks financing is licensed as Intuit financing.

For further assistance on this topic or any query related to accounting and bookkeeping, directly reach us by dialing our toll-free +1-844-405-0904.