In this article, we’ll discuss the questions to ask when choosing a tax preparer. It is always preferable to do your own taxes but sometimes it is not possible due to some reasons like the tax return is too much complicated or you don’t possess enough knowledge to file a tax return. In this case, it is best to hire a tax preparer who’ll file the tax return on your behalf. For now, go through the article and collect the answers to the 12 most commonly asked questions, and get your query resolved. For more info contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

Table of Contents

What are the questions to ask when choosing tax preparer

These are the questions that you need to ask so that you can hire the best tax preparer at an affordable fee and will help you in getting the credit and tax refunds that you are qualified for.

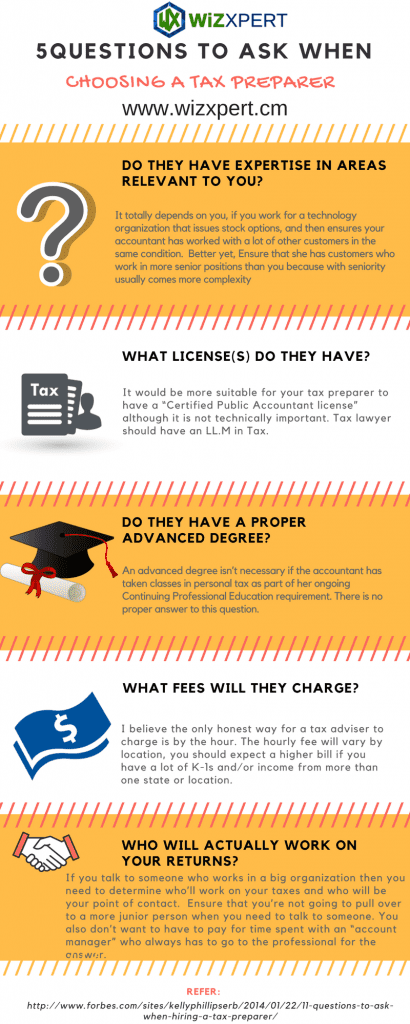

1. Do they have expertise in areas relevant to you?

It totally depends on you, if you work for a technology organization that issues stock options, and then ensures your accountant has worked with a lot of other customers in the same condition. Better yet, Ensure that she has customers who work in more senior positions than you because with seniority usually comes more complexity. A true expert will tell you if she is not appropriate for the job, either because your return is too simple to warrant her help or too complex due to her lack of experience.

2. How many years of individual tax experience do they have?

A suitable tax adviser should have a minimum of four to five years of experience doing individual tax returns.

3. How do I choose a good tax preparer?

10 ways to choose a tax preparer

- Check the Qualifications.

- Check the preparer history.

- Ask about service fees.

- Ask to E-files.

- Make sure the preparation is available.

- Provide records and receipts.

- Never sign a bank returns.

- Review before singing.

- Ensure the preparer signs and includes their PTIN.

- Reports abusive tax preparers to the IRS.

4. What license(s) do they have?

It would be more suitable for your tax preparer to have a “Certified Public Accountant license” although it is not technically important. Tax lawyers should have an LL.M in Tax.

5. Do they have a proper advanced degree?

An advanced degree isn’t necessary if the accountant has taken classes in personal tax as part of her ongoing Continuing Professional Education requirement. There is no proper answer to this question.

6. Do they have a genuine PTIN ( IRS Preparer Tax identification number)?

This is an identification number issued by the Internal Revenue Service (IRS) to the agents who file the taxes. This identification number doesn’t mean that the tax preparer is certified, educated, or experienced in any means.

7. What fees will they charge?

I believe the only honest way for a tax adviser to charge is by the hour. The hourly fee will vary by location, you should expect a higher bill if you have a lot of K-1s and/or income from more than one state or location.

8. What can the client or customer do to keep their fees down?

The better organized you are, the less time your accountant will need to find the details which translates to lower fees. Don’t dump a bunch of crap on your CPA that she has to decode.

9. Make sure that your tax refund will come back to you, not to the preparer.

Whenever IRS sends you tax refunds make sure it directly came to you or deposit into your bank account. It is not appropriate if your tax preparer is insisting on refunds to go through their office.

10. Who will actually work on your returns?

If you talk to someone who works in a big organization then you need to determine who’ll work on your taxes and who will be your point of contact. Ensure that you’re not going to pull over to a more junior person when you need to talk to someone. You also don’t want to have to pay for time spent with an “account manager” who always has to go to the professional for the answer.

11. Do they provide audit assistance or not?

While hiring a tax preparer that they also provide you audit assistance. Usually, tax preparers are only authorized to provide audit advice and that’s why they are cheaper than CPA and other agents. They may charge you some extra fee if you to them accompany you to an audit with IRS or speak on your behalf to IRS.

12. Does your adviser need to be local?

This is the actual question for you and not your potential tax adviser. It is not necessary for your accountant to be local given the ease with which you can send documents via mail or another way. It really comes down to whether you need to actually see your accountant get comfortable with his advice.

The Bottom Line

Above we’ve mentioned all the important questions you need to ask before hiring a tax preparer and we hope that you find our article useful. If you are still finding difficulties in accounting and bookkeeping then we recommend you to have assistance from our customer support via our 24/7 toll-free support number +1-844-405-0904.