In this digital era, fraud is present and happens everywhere. If you run a business and handle your own accounting to manage business expenses, then accounting security is crucial. Because accounting is an essential and sensitive part of the business, there are many chances of fraud happening. But when your employee uses the lapping scheme to take money from your business account, then, for that situation, you have to know “what is lapping in accounting?”. So in this blog, we are discussing lapping in accounting with the lapping fraud scheme detection and prevention method in detail.

What is Lapping in Accounting?

Every business uses different and unique security methods to get relief from fraud and manage the account properly. When your employees commit fraud by taking the receivable amount of a client and hiding it by adjusting the invoices and covering the theft, that is known as lapping in accounting. Generally, lapping in accounting was happening in smaller companies where a single person was managing the customers’ bills and cash receipts.

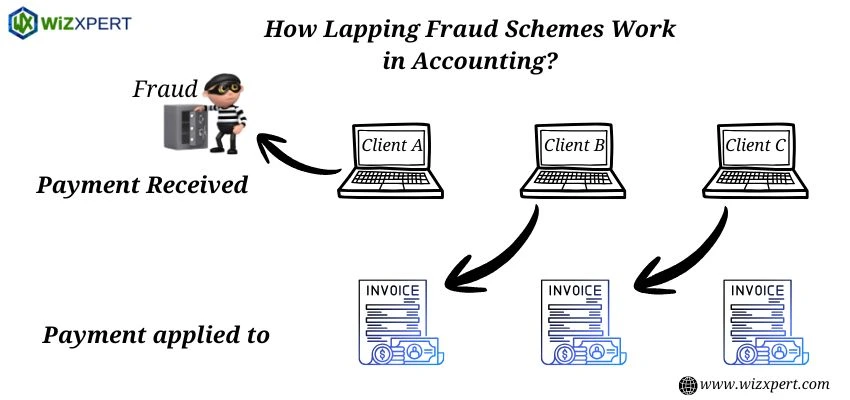

How Lapping Fraud Schemes Work in Accounting?

In Lapping fraud scheme in accounting, own business accountants are transferring the customers’ receivable amount to their personal accounts and adjusting the invoice by adding another customer’s payment, and lapping process can’t be stopped.

For example, let you are applying an invoice to three clients, such as client A, client B, and client C. To start the lapping fraud scheme, employees take the receivable amount of client A and cover the client A invoice by adding the client B receivable amount. Similarly, to cover the client B invoice, they are adding the client C receivable amount and so on.

How to Detect Lapping in Accounting?

To detect lapping in accounting, you needs to need to track the cash receipt and find how it is applied to accounts receivable. There, if you see that the cash receipts are continuously applied to the different and wrong customer account. Then it ensures that lapping in accounting is in progress.

When you detect any accounting employee exhibiting abnormal behaviour (such as rejecting the vacations, being overly protective and overly possessive of their work, managing accounts to cover up stolen funds). Then you need to track their work and the cash receipts carefully. Because the lapper needs to adjust their fraud by adjusting it every day by applying a cash receipt to the wrong client’s account, and that process never stops.

How to Prevent Lapping in Accounting?

When you build your business, you decide to provide quality products or services to customers and earn customers’ trust, which helps to grow your business. But if it stolen amount can not be recovered, you have to record it as a loss. A lapping fraud scheme cannot possibly hide for a long time, it is a short-term or temporary process where own employees are trying to commit this fraud. So to run your business smoothly without any fraud, you have to know the way to prevent lapping in accounting. Below, we are providing the way to prevent a lapping fraud scheme in accounting.

- Assign more than one employee to manage accounting.

- Provide cashier and billing responsibilities separately.

- Rotate your accountant’s responsibilities frequently.

- Make mandatory rules for employees to take their vacation time.

- Regularly inspect the cash receipts transactions.

- Put a “For Deposit Only” stamp on every check.

- Convince customers to pay directly to a lockbox for secure transactions.

There are also some tools available that help you to prevent lapping in accounting.

- ERP systems such as Oracle, QuickBooks, and SAP.

- To track Employees’ activity, you can use audit trail monitoring software.

- For ageing & receipt patterns, you can use Power BI dashboards.

- To compare internal cash records of a business with its bank statements, you can use bank reconciliation systems.

Conclusion

After learn the blog, we have concluded that lapping in accounting is a fraud that happens with businesses or banks by their own employee or accountants. This lapping fraud looks like a chain system where lappers adjust the invoice by adding another customer payment. In this blog, you can understand “what is lapping in accounting?” with the working process, and the detection and prevention process of lapping in accounting in detail. We hope you all are clearly understand the lapping in accounting.