Are you an entrepreneur and looking for a tool to manage your taxes and expenses like QB Self-Employed? In this article, we will be reviewing QuickBooks Self-Employed: what it is, its features, its plans & cost, how you can upgrade or degrade your plan along with its pros and cons. We have also provided video tutorial support to give you a better understanding. For more details dial our toll-free number +1-844-405-0904.

Table of Contents

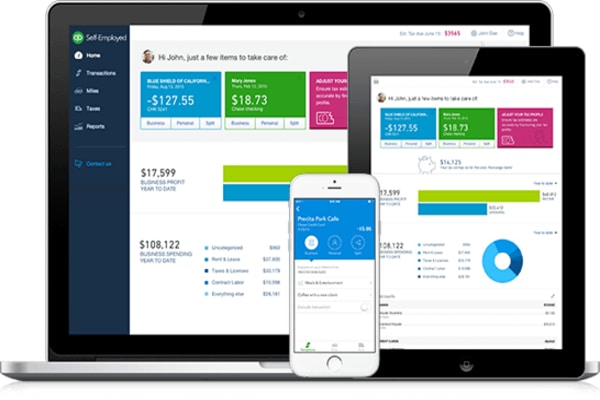

What is QuickBooks Self-Employed

QuickBooks self-employed is a business tool for freelancers, contractors, and sole traders. It helps in tracking income, and mileage and staying in control of your finances at tax time. You can sync your data and access your accounts from a web browser or mobile app.

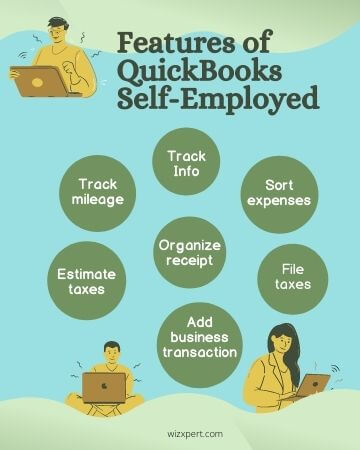

Features of QuickBooks Self-Employed

QuickBooks Self-Employed is a tax software that is connected to a cloud-based system that helps you explore the benefits. It helps you to keep track of your income and expenses. Some other features are:

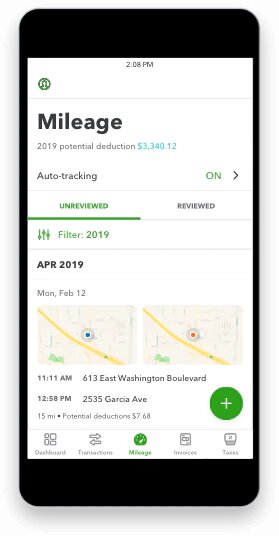

Track mileage: With automatic mileage tracking you can track miles without draining your phone’s battery. The mileage data is saved and categorized to maximize deductions.

Run Reports: Quickbooks self-employed has built-in reports that can be useful for an organization that helps in reviewing your business and how your company is doing and then make plans and strategies accordingly.

Sort expenses: You can easily import expenses from your bank account directly and sort business from personal spending. Also, save time on taxes by tracking all expenses in one place.

Organize receipt: You can organize your receipt and keep it ready for tax time. Expenses are categorized automatically and you seamlessly enter your transaction information. You can also snap a photo of your receipt and forward it directly from your mail.

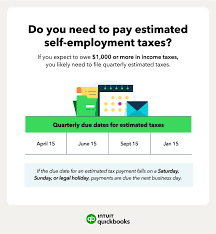

Estimate taxes: With the automatic reminders of quarterly tax due dates you can avoid your late fees. You Easily organize income & expenses for instant tax filing.

File taxes: Instantly transfer your financial data entry by connection to TurboTax Self-Employed. Put your expenses into the correct Schedule C and categorize transactions, and easily transfer Schedule C income and expenses.

Add business transaction: You can easily add transactions into QuickBooks self-employed by just connecting your bank and credit card accounts to QuickBooks self-employed. It will automatically download your latest transactions. You have to categorize them to correctly show up in the Schedule C category and on your financial reports.

Track Info: QuickBooks Self Employed record and categorize transactions and include them as a part of your federal estimated quarterly tax payments. This will create an estimated amount to pay the IRS for taxes. Transactions for your Schedule C and annual tax return are also categorized by the QuickBooks Self-Employed.

Tag Setup: In the updated version of QuickBooks Self-Employed, you are allowed to create tags while filling out a form of invoices and expenses from the transaction menu. Then select the tag field enter the name of the tag and then select group. With the help of tags, you can track more details about the locations.

Plans and Pricing Of QuickBooks Self-Employed

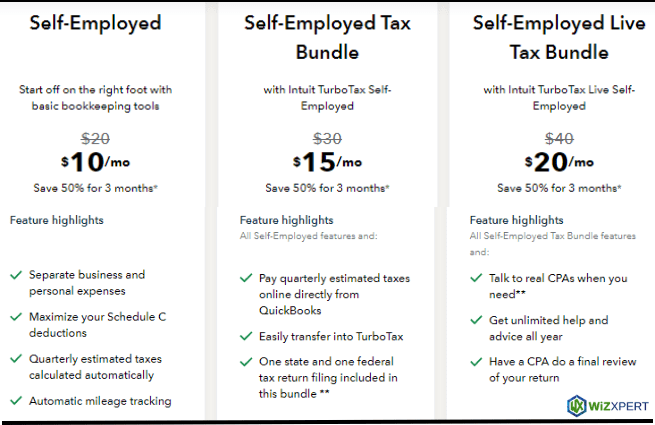

There are basically three types of plans available:

- QuickBooks Self-Employed

- QuickBooks Self-Employed Tax Bundle

- QuickBooks Self-Employed LiveTax Bundle

1. QuickBooks Self-Employed (Self-Employed)

Self-Employed is the most basic version of QuickBooks Self-Employed. It comes at only $10 per month.

Features included in QuickBooks Self-Employed

Surprisingly, it has a very low cost but still, it comes with lots of features. You can send and track simple invoices, have access to monitor open invoices, and clear overdue notifications. It has other features which are given below:

- In The updated QuickBooks Self-Employed, you can separate the expenses of your business and personal.

- It also helps in maximizing your Schedule C deductions in which you have to report your income and expenses.

- Help in calculating quarterly taxes.

- Transactions from your bank, credit cards, PayPal, Square, and other sources can all be imported.

- Sort transactions into tax categories automatically.

- Take a picture of your receipts and they’ll be automatically matched to your existing expenses.

- Stop missing out on business expense deductions by snapping and storing receipts.

- With the Self-Employed mileage tracker, you can deduct every mile you drive for work.

- Sort business expenses into the appropriate tax categories automatically to keep more of what you earn.

- Know what you owe each quarter before taxes are due.

- Automatic reminders of quarterly tax due dates to avoid late fees.

- Easily organize income & expenses for instant tax filing.

- Reliably and automatically track miles with your smartphone’s GPS.

- Categorize business and personal trips with a swipe and add trips manually.

- Get shareable reports that break down miles driven and potential deductions.

2. QuickBooks Self-Employed Tax Bundle

This is the second plan for this software. You will receive additional tax features in this plan to further optimize your financial process. QuickBooks Self-Employed Tax Bundle cost is $15 per month. Just the same as in the Self-Employed has lots of features at a great price

Features included in Self-Employed Tax Bundle

The main difference between the three plans is features-related tax. It has all the facilities of the first plan but it has some more additional features also:

- Ability to pay taxes directly from QuickBooks.

- Accurate estimates of quarterly taxes.

- Seamless transfer to TurboTax with built-in integration.

- E-file returns with direct deposit to receive tax refunds faster.

- Export Schedule C directly into the Turbo tax.

- One state and one federal tax return file is included.

3. QuickBooks Self-Employed LiveTax Bundle

It comes with the highest price range but with more comprehensive features and tools to manage their business expenses and finances. Its cost is $20 per month.

Features included in QuickBooks Self Employed Live Tax Bundle

It has the most extensive tax functionality. It has all the features of the other two plans with some additional features.

- Live, personalized advice from TurboTax certified public accountants (CPAs) and Enrolled Agents (EAs)

- Unlimited year-round access to tax experts with 15 years of experience

- A CPA or EA to review your tax return, line by line, and sign it to ensure it’s completed correctly.

When to use QuickBooks Self-Employed:

Use or log in to QuickBooks Self-Employed if you want to file a Schedule C and pay expenses with a debit or credit card. If you are writing checks manually every month and don’t have employees and contractors. It is also helpful if you do your own taxes, QuickBooks Self-Employed TurboTax bundle will allow transferring data to TurboTax.

In a simple way, QuickBooks Self-Employed works for individuals and businesses that meet the following criteria:

- Files a Schedule C with Form 1040

- Pay expenses by debit card, credit card, and cash. It reduces the use of paper checks.

- It’s limited to writing five checks per month.

- No more than 10 invoices per month

- Does not employ any contractor

- And does not have any employees as this tool does not have payroll functionality.

If you want to employ contractors they are paid $600 per year. Then you need to complete the 1099 reporting. And it doesn’t support it.

How to Upgrade to the QuickBooks Self-Employed and TurboTax Self-Employed Bundle

Learn how to upgrade your subscription to a tax bundle

On an iPhone or iPad (iOS)

- Go to the profile icon.

- Click Settings and then Subscription.

- Swipe until you see the QuickBooks Self-Employed + TurboTax Bundle.

- Select Subscribe now.

- Follow the steps to upgrade.

On a phone or tablet with an Android

- Click on the menu ☰ icon.

- Select your profile icon and then Subscription.

- Swipe left and select Change subscription now.

- Go to Next and follow the steps to upgrade.

On a web browser

- Click on the profile ⚙ icon and then Billing info.

- Look for the TurboTax logo and select Get our Tax Bundle.

- Select Subscribe Now or Switch Now.

- Follow the steps to add your payment info.

- Select Subscribe to bundle.

- When you’re ready, select Done.

How to Downgrade your Subscription to QuickBooks Self-Employed only from Tax Bundle

Learn how to change your plan to QuickBooks Self-Employed only.

On a web browser

- Go to the profile ⚙ icon and then Billing info.

- Click on Cancel now.

- Select the Keep QuickBooks Self-Employed option.

- Click on Change subscription.

On an iPhone or iPad (iOS)

- Close the QuickBooks Self-Employed app.

- Open your Device Settings for your mobile device.

- Select Your Name.

- Go to iTunes & App Store.

- Select Subscriptions.

- Find QuickBooks Self-Employed.

- Click the standalone option.

- Follow the onscreen steps to change your subscription.

On an Android phone or tablet

- Go to the menu ☰ icon.

- Click on Settings.

- Select Subscription.

- Choose Change Subscription.

- Follow the on-screen steps to change your subscription.

QuickBooks Self-Employed Expense

QuickBooks Self-Employed Expenses helps with expense categorization and manages business expenses, automates mileage tracking, and uploads receipts.

- Expense Tracking: It helps in business monitoring, categorization of expenses, and making balanced financial reports. You can simplify your budget or tax deductions by tracking expenses.

- Mileage Tracking: You can track your business miles automatically to help you claim mileage deductions for tax savings.

- Receipt Uploading: You can take a photo of your receipts and extract the details into an organized book for easy access with QuickBooks.

- Tax-Ready Reports: QuickBooks generates Schedule C and Schedule SE tax reports, making tax filing simpler and more accurate.

- Account Syncing: This means connecting bank accounts and credit cards, and QuickBooks will import and categorize all transactions automatically.

- Recurring Bill Management: Monitor, set reminders, schedule, ensure you pay regular bills on time

- Quick Budget Overview: It shows a live picture of your profits and losses and therefore provides transparency concerning your corporation’s finances.

QuickBooks Self-Employed Taxes

The QuickBooks Self-Employed Taxes is used by freelancers and independent contractors and makes tracking expenses, and calculating and filing taxes simple. It reduces the complexity of claiming tax deductions, guarantees accuracy, and optimizes tax savings on a self-employed person’s tax report.

Tax Forms

Most companies send the tax form to everyone for the last year at the start of the year. Individuals and freelancers are also included in this point. You must fill out the tax forms and submit them. The tax forms are as follows:

- 1099-MISC

- Form 1040( Schedule SE)

- Tax Form 1040

- Form 1040 ES

- Schedule C

Estimated Tax

Estimated tax for the self-employed is the quarterly payment you make to cover income, Social Security, and Medicare taxes. It prevents penalties by paying taxes on income earned during the year in advance.

Self-Employed Tax

In America, each self-employed person pays taxes based on Medicare and Social Security from their annual income. Tax Types: There are two types of taxes (SECA tax) if you are self-employed, and (FICA tax) if you are an employee. If you are working for yourself, you need to pay 15% of your income, and if you are working as an employee, you will need to pay 7.5% of your income, and the employer pays the other 7.5% for you.

Tax deduction

Here are some examples of tax deductions:

- Auto Expenses

- Internet

- Utility Bills

- Marketing Expenses

- Office Supplies

- Meals

- Self Employment Tax

Pros and Cons Of QuickBooks Self-Employed

There are varieties of software available in the market. So, choosing the best option that matches your needs and requirements sometimes becomes difficult. Below are listed some of the pros and cons of QuickBooks Self-Employed which will help you in making your final decision.

Pros:

- User-friendly

- It helps in tracking mileage

- There is an option to invoice multiple customers and clients

- Provide a mobile app so you can create invoices in QuickBooks self-employed, track mileage, and organize your income and expenses on the go

- Manage income and expenses for Schedule C

- It helps you to calculate quarterly taxes and allows you to pay them online at any time. And save yourself by paying penalties.

- Different options for pricing according to the plan

- It has been the ability to print off multiple reports for your bookkeeper, accountant, or even for your records.

Cons:

- Not possible to accommodate invoices outside of your name, address, logo, etc.

- It doesn’t provide you with support for state, country, or city taxes. So, if you have requirements for any of these you have to figure them out by yourself if your state, country, or city requires it.

- It is difficult to migrate to another accounting software by chance if it doesn’t work, even if you’re just migrating to new options.

- There is no option available for time-tracking, so it needs to be used as a separate tool for it.

System Requirement for QuickBooks Self-Employed

Self-employed, Self-Employed Tax Bundle, and Self-Employed Live Tax Bundle all require high-speed internet connections. It also requires a system-supported internet browser like Google Chrome version 78 or above and if you use Mozilla Firefox then version 76 or newer is needed. If you are a Mac user then you have to install version 12 or newer. It can also be used in a mobile phone that supports an operating system. If you used it on your Laptop then it requires Windows 10 with at least 4 GB RAM.

QuickBooks Self-Employed Video Tutorials & Support

- Getting started

- Mobile app

- How to Track GST w/ QuickBooks Self-Employed on Your Mobile

- How to Categorise Expenses w/ The QuickBooks Self-Employed App on Your Mobile

- How to Use QuickBooks Self-Employed on Your Mobile

- How to Send Invoices on The Go w/ QuickBooks Self-Employed on Your Mobile

- How to Categorise Expenses w/ The QuickBooks Self-Employed App on Your Mobile

- How to Automatically Track Your Mileage w/ QuickBooks Self-Employed on Your Mobile

- How to Add Your Bank Account on QuickBooks Self-Employed on Your Mobile

- Web version

- How to Start Using QuickBooks Self-Employed on Your Computer

- How to Create, Send & Track Invoices w/ QuickBooks Self-Employed on The Web

- How to Categorise Expenses w/ QuickBooks Self-Employed on The Web

- How to Connect Your Bank to QuickBooks Self-Employed on The Web

- How to Add Receipts & Expenses to QuickBooks Self-Employed on The Web

- Mileage

- Invoicing

- Expenses

- GST

- Bank account

- Receipt Capture

If you are a freelancer or solopreneur with no employees or contractors, QuickBooks Self-Employed is for you. You can sign up for the standard version, and then upgrade to the TurboTax bundle whenever you’re ready. It has significant capabilities for managing expenses, preparing taxes, and tracking mileage, and can help you automate and streamline your processes. For more information reach out to us at [QuickBooks].

FAQs

What is Schedule C?

Schedule C forms are issued by the IRS to determine how much profit and loss is made by your organization. If you are self-employed, a freelancer, a contractor, or a small business owner then you need to attach the 1040 tax return form while filing your taxes.

How does QuickBooks Self-Employed work?

If you are a Freelancer or small business owner using QuickBooks self-employed then it helps in many ways with the feature of automation and reduces the time. It imports transactions automatically as well as export Schedule C form. It also tracks mileage automatically and maximizes deductions at tax time.

What information is on Schedule C?

On Schedule C many items are asked related to your trade or business including:

1. Organization name and address

2. Product and service offered by your company

3. Cost of goods sold used in your business.

4. The vehicle used in your business

5. Business expenses like insurance, legal and professional services, rent or lease payments, repairs and maintenance expenses, advertising, utilities, wages, etc.

6. Accounting method: cash, accrual, or other.

How do I get Schedule C?

If you need Schedule C then you have the option to download directly from the IRS website. You have also the option of completing your tax return by using online tax preparation software.