In this article, we will discuss the use of accountant tools in QuickBooks Desktop Enterprise and QuickBooks Online. This software enables the use of accounting tools for all Enterprise clients. These tools were previously available in the QBES accountant version only and simplify the performance of several critical accounting tasks. Go through the article to know how to access the tools, and how they function as such information. For more info Contact us toll-free:[QuickBooks]

How to Access the Accountant Tools in QuickBooks Enterprise

Follow these steps to access the accounting tool, if you have a regular version of QuickBooks Desktop Enterprise installed on your system.

- Firstly you have to open the QuickBooks Desktop Enterprise.

- Then secondly you have to click on the company name.

- Then choose Accounting Tools.

- After that, select the desired accounting tool.

Note: After bringing up each tool, you can click How this works in the upper right of the screen for specific details on how to use each one.

What are the uses of accounting tools in QuickBooks Desktop Enterprise

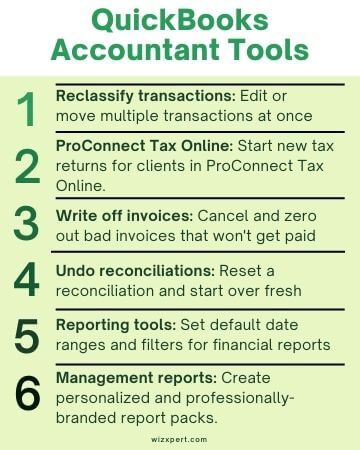

Here, we will reveal some of the most beneficial accounting tools that only get with QuickBooks Enterprise Solutions.

Review list changes

Review list changes accounting tools help in showing the related data from chart of accounts, payroll items, fixed asset list and item list for review that include editable reviews notes.

Troubleshoot Prior Account Balance

This tool helps to show the differences of the opening balance and your record and adjusting entries.

Write off invoices

It helps in write-off a group of invoices that create the credit memo of every write-off invoice and add a memo to both bill and credit memo.

Fix Unapplied Customer Payments and Credits

Fix unapplied customers payments and credits tools permits identifying and applying payments that helps to open invoices.

Clear Up Undeposited Funds Account

Clear up undeposited funds account tool allows to view and linking the manual deposits to the appropriate payments.

Fix Unapplied Vendor Payments and Credits

This tool help to applying and identifying payments or credit to open bills.

Fix Incorrectly Recorded Sales Tax

This tool helps to identifies the sale tax payments but unrecorded and let you record accurately.

Compare Balance Sheet and Inventory Valuation

Compare Balance sheet and inventory valuation accounting tool helps reconciliation of the balance in your inventory account, when it had been opened, it also examined the inventory account as well as the inventories summary and presented the outcomes.

Troubleshoot Inventory

Troubleshoot inventory accounting tool helps to show the potential inventory so that it is quickly identifies problems and solve it.

Find Incorrectly Paid Payroll Liabilities

Incorrectly paid payroll liabilities accounting tools helps to identifies the payroll tax liabilities that have been paid by regular checks.

Working Trial Balance

This tool is very helpful to create a trial balance that involves the initial balance, the sum of transactions and arrangements, and the ending balance. In addition, the tool also involves a location for judgments and records about the review.

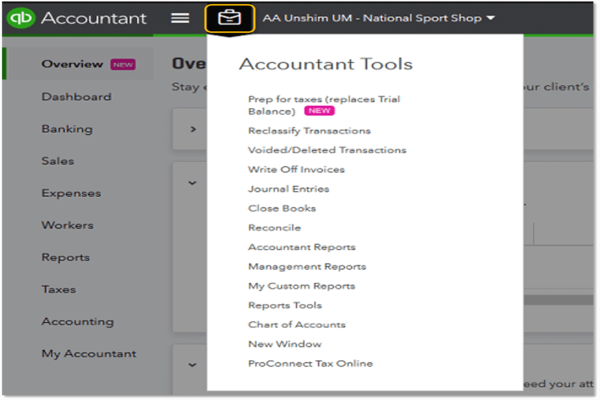

How to access Accountant Tools in QuickBooks Online

For more information and advice you can talk to our experts by dialing our toll-free+1-844-405-0904 and getting in touch with our intuit certified professionals. We will be pleased to help you.