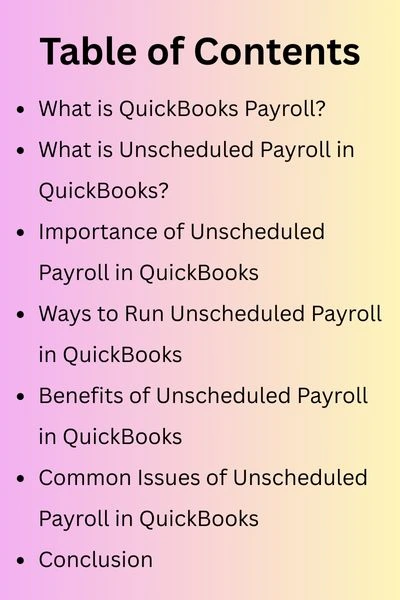

Every business, Payroll management is an essential things that increases employees’ trust level and also provide motivation for proper work when the employee’s salary is credited on time. QuickBooks is an accounting software used to manage business finances and accounting. It simplifies and automatically manages the payroll. There are many types of payroll options like scheduled payroll, unscheduled payroll and termination payroll, that play a major role in business growth. So, in this blog, we are discussing the detailed information of Unscheduled Payroll in QuickBooks with its importance and benefits.

What is QuickBooks Payroll?

QuickBooks Payroll is the cloud-based software solution for all payroll issues. It reduces the manual work and provides its automated Payroll service with tax calculations and direct deposit for small to large-sized businesses. It also manages employees’ salaries, hourly wages, commissions and bonuses automatically based on the entered details. It saves time and effort because of its user-friendly interface.

What is Unscheduled Payroll in QuickBooks?

Unscheduled Payroll means a user uses the payroll facilities of a particular platform for their business payroll when needed. QuickBooks is the best platform you can use to manage your business payroll easily. Normally, Payroll runs with a fixed schedule. That may be weekly, bi-weekly or monthly. There are no proper schedules fixed to run the Payroll. A business owner has to process the salary apart from the confirmed date. In that situation, a business owner can easily use Unscheduled Payroll in QuickBooks. Which is more relevant and user-friendly than other platforms.

Importance of Unscheduled Payroll in QuickBooks

A Business owner takes every employee’s responsibility. In some cases, like.

- Employee Emergency: Some employees need to advance salary in some emergency cases.

- Overtime & Bonus: If an employee needs to be given a bonus or an incentive that is not added to the regular payroll.

- Correction in Salary: If any correction needs to be made that were missed in the last payroll.

- New Hire Salary: If an employee joins after the scheduled payroll and you need to release their first salary.

In those cases, Unscheduled Payroll plays a major role in solving those types of issues. With the Unscheduled Payroll in QuickBooks, you can release your employees’ salaries without waiting for the scheduled date.

Ways to Run Unscheduled Payroll in QuickBooks

QuickBooks is the best Accounting Software, which provides two ways to access that are QuickBooks Online and QuickBooks Desktop. Both are almost the same, but the only difference is that QuickBooks Online runs in a Browser and QuickBooks Desktop runs in your system through the QuickBooks App. But the process to run Unscheduled Payroll in QuickBooks is are same in both software.

- First, you need to open your QuickBooks Software and go to the Payroll section.

- Then select the Employees option from the menu bar and click on the Pay Employees.

- QuickBooks displays the three options: termination, unscheduled and scheduled payroll. There, you need to select the Unscheduled Payroll option.

- After that, select your employee to whom the payment is to be made.

- Now enter the payroll details like employees’ working hours or extra earnings, etc.

- After that, once you have cross-checked all the details then click on submit. QuickBooks will automatically calculate all the taxes and deductions and display the net salary.

- Now just choose the payment method and release the employee’s net salary.

Benefits of Unscheduled Payroll in QuickBooks

To use Unscheduled Payroll in QuickBooks, there are many benefits are occur, which help to maintain the trust and increase the motivation level of the employees for the company. This is the best step for business growth.

- Flexibility: By using Unscheduled Payroll, you can release an employee’s salary at any time.

- Employee Satisfaction: This made the employees loyal because of the instant solution to employees’ problems.

- Error Correction: If there is any mistake in the earlier payroll, then it becomes easy to rectify it.

- Bonus & Incentives: By the unscheduled payroll, you can provide Performance-based rewards that can be easily distributed to employees.

- No Delay in Payment: There is no need to wait for the regular payroll cycle.

Common Issues of Unscheduled Payroll in QuickBooks

As you know, every best thing has some disadvantages or issues. Like that, the Unscheduled Payroll in QuickBooks has some issues. You need to stay careful about that.

- Time Consumption: It takes more time because every unscheduled payroll must be run separately.

- Extra Cost: In some cases, Unscheduled Payroll charges extra service charges for the additional payroll runs.

- Over-Dependency: If unscheduled payroll is done for every small thing, then the workflow can get disrupted.

So for that reason, you need to carefully decide when you can run Unscheduled Payroll and when not.

Conclusion

Unscheduled Payroll in QuickBooks is the best feature, which gives you the flexibility and total control to grow your business. It fulfils the employees’ urgent needs and they receive great rewards for their work. If you are running a business, then you can keep your employees satisfied and motivated by using a smart combination of both scheduled and unscheduled payroll in QuickBooks. If you are facing any problem running Unscheduled Payroll in QuickBooks, then immediately contact the QuickBooks Expert for the Instant Guide.