If you want to take a loan for your organization at a good interest rate. Then you can take a mortgage loan, which is the oldest and the popular way of taking a loan from a bank, investor, or lender. If you are a QB user, then you can set up a mortgage loan in QuickBooks Online, which will help you know how much loan amount is remaining to pay. QBO will also send you a monthly notification to pay the loan amount.

Here, we will help you learn about setting up a mortgage loan in QuickBooks Online and the benefits of entering the mortgage loan in QuickBooks Online Software.

What is a Mortgage Loan?

A mortgage loan is a type of loan in which you have to keep your house or other property as a guarantee to the lender for getting the loan. It is one of the oldest methods practiced to give a loan to anyone. That property will be with the lender until you pay back the loan. You have to pay the principal amount and the interest amount as demanded until you have fully paid the loan amount to the lender.

If you fail to pay the loan within the given time, then the lender has the right to sell the property to get its lended money back.

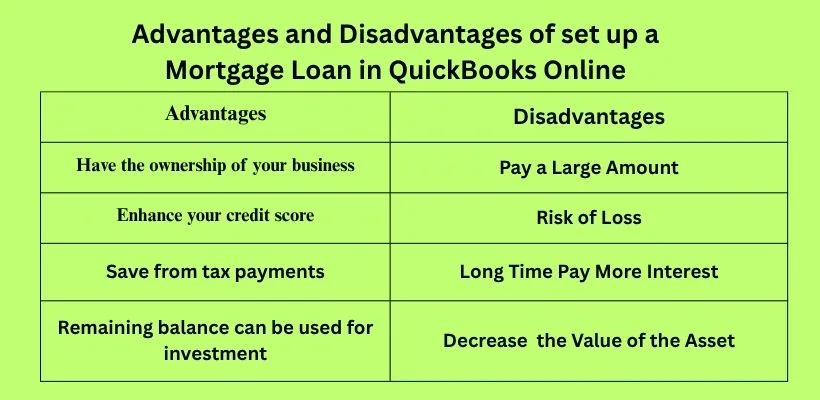

Advantages and Disadvantages of Set Up a Mortgage Loan in QuickBooks Online

Every loan has some advantages and disadvantages. We know that Set Up a Mortgage Loan in QuickBooks Online is the oldest methods, so it is popular. But it has some major advantages and disadvantages that may affect your financial condition.

Advantages of Set Up a Mortgage Loan in QuickBooks Online

Some of the common advantages of set up a mortgage loan in QuickBooks Online.

- Ownership: When you take a mortgage loan for business, you can maintain the ownership of your business.

- Credit Score: If you are taking a mortgage loan, when you pay for that loan, it will help you enhance your credit score with the first payment.

- Tax Relief: When you are paying the mortgage loan, it will help you save from tax payments.

- Investment: After paying the monthly loan, the remaining balance can be used by you to invest to earn some extra income.

Disadvantages of Set Up a Mortgage Loan in QuickBooks Online

Some of the common diadvantages of set up a mortgage loan in QuickBooks Online are:

Pay a Large Amount

When you take a mortgage loan, you have to pay a large amount and a large interest rate for a long period. Which will really affect your income and the cash flow record, also.

Risk of Loss

A Mortgage loan is the best way to buy a new thing, but it also involves the risk of loss of that thing if you can’t pay the amount timely. Your home will act as a guarantee for the loan. If you fail to pay the monthly amount for some months, then the lender has the right to sell your house to get the rental money.

Long Time Pay More Interest

A major disadvantage of a mortgage loan is that you have to pay the loan amount with the interest rate on time. If you failed to pay the total amount on time, then the lender can also increase the interest amount for a longer time.

Decrease the Price of the Asset

A mortgage loan will act as a red mark on a home that needs to be fixed before selling it. If you try to sell the property, then the lender can ask you to pay the whole loan amount before selling the property to someone else. This can really affect the cost of your property in the market.

Steps to Set up a Mortgage Loan in QuickBooks Online

You can easily set up a mortgage loan in QuickBooks Online application to get a monthly reminder to pay the loan amount with the interest amount.

Access the chart part of the account

In the QB account, click on the chart of accounts.

Create a New Account

Do a right click and select the new option.

Create a Loan Account

- Select the type of account: Press the other account type option from the dropdown menu and select long-term liability click the continue button.

- Name Account: From the menu, enter the name of the loan.

- Opening Balance: Click to enter the opening balance option. Enter the total amount of the loan you want at the beginning.

- Loan Received Date: Enter the date when you received the loan amount in your account.

- Confirmation: After confirming the data, click on the save button and press the new button.

Create an Escrow Account for a Mortgage Loan

- Account Type: Press the dropdown menu and select the other Current asset from the options.

- Name the Escrow Account: Enter the account name( as mortgage loan), give the opening balance amount, and the loan received date.

- Confirmation: Confirm all the data that you have entered and press on save button.

Create Expense Account

- Expense Type: Press on the dropdown option and click on the expense option from the list.

- Name the Account: Assign the account as the name Interest.

- Save Button: Press the save changes button and click ok to finish it.

How to Record Mortgage Payment in QuickBooks Online?

Liability Account

- In the settings and click on the chart of accounts Option.

- Press New and select long-term liability.

- Name it as Mortgage Payable.

Record Mortgage Loan

- Press to +New and open a journal entry.

- Enter the Debit Bank account to know the amount received.

- Enter the credit Mortgage payable contains the loan amount.

- If any other fees are present, then mention them as a credit Escrow.

Add Mortgage Payment Amount

- Press the +New option and check the expenses data.

- Search for the bank account and click on it.

- Mention the lender as payee.

- Enter the amount like the Mortgage amount as the principal, the amount of interest charged on the loan, and the Escrow account if required.

- Press on save button and close it.

Save Button

After confirming all the data, click on the save button and close it.

Conclusion

No doubt Mortgage loan is the oldest way of borrowing money to buy new assets. But some lenders take advantage of it. Always try to pay the loan amount on time to save your guaranteed property from getting lost. If you still have any confusion related to set up a mortgage loan in QuickBooks Online, then you can talk to our QuickBooks expert teams.