Managing the record of credit card payments accurately is crucial for all-sized businesses. Adjusting your finances in QuickBooks needs careful attention to keep details, especially when it comes to categorize a credit card payment in QuickBooks. Whether you’re a small-sized or medium-sized business owner, or managing your personal finances. Carefully and properly categorizing these payments make you sure on accurate reporting of finances, helps to track expenses, and simplifies tax preparation.

In this blog, we’ll guide you through the process of categorize a credit card payment in QuickBooks, highlighting its common mistakes, best practices, and help you to master it quickly and easily.

Understanding Credit Card Payments in QuickBooks

The QuickBooks Credit Card process just works like a separate account book that tracks only those things that you already have. When you make any payments with your credit card to reduce the liability and not to create new expenses, you’re transforming money from your bank to make it possible. When you use your card by swiping for purchases, your expenses are already recorded. Don’t choose the expense category like “Office Supplies”; always try to choose the credit card account as the payment category to stay accurate.

Through this process, your books are kept as balances, preventing the cost of double-counting, making it easier to reconcile your statements. Think properly before doing it; otherwise, your bank account decreases, and your credit card balance will go down.

Why is Categorize a Credit Card Payment Important in QuickBooks?

It is important when you categorize a Credit card payment in QuickBooks because your business finances are kept accurate and organized. QuickBooks knows better. While your payments are categorized and recorded correctly, the payments of expenses reduce a Credit card balance or move the money between accounts. This ensures your reports, like profit and loss statement, cash flow to stay organized while double-counting expenses are get prevented by it. You can make it easier to track spending, reconcile statements, and prepare your taxes without any confusion by proper categorization.

How do you Categorize a Credit Card Payment In QuickBooks?

You can transfer your money from your bank to your credit card account while you categorize a Credit card payment in QuickBooks. It avoids double-counting, always keeping your expenses accurate and organized for QB software. You can simply match the payment instead of recording it as an expense to the correct Credit card account.

Here are the steps to categorize a credit card payment in QuickBooks, mentioned below:

- Open the page of transactions.

- Select the bank accounts that are used for making payments.

- Look over the Credit card payment option.

- To transfer, select the option for the category to get matched.

- Choose any Credit card accounts that are related.

- Save them to confirm.

Matching Transactions from Bank Feeds

In QuickBooks, when you make a payment with a Credit card, it shows in your bank feed, and the charges fees also show in the Credit card feed. You must match them to avoid double-counting. First, categorize a Credit card payment in QuickBooks as a transfer. Then, QuickBooks will detect this payment in the Credit card feed and show a “match” option. Instead of adding a new expense, click on the Match option. To keep your accounts accurate and prevent duplicates in your financial records, make a connection between the bank withdrawal & a Credit card payment.

Common Errors When Categorizing

People start recording and categorize a Credit card payment in QuickBooks as expenses instead of making transfers, duplicating transactions, skipping bank-to-card matching, or forgetting fees. Through these mistakes, wrong balances and reports are being created. So, don’t use a Credit card for purchase; always use it to transfer money from the bank account to the card.

Some steps to avoid errors while you categorize a Credit card payment in QuickBooks are as follows:

- In QuickBooks, attach both your bank and Credit card accounts to connect them.

- Choose “Transfer” to record the Credit card payments.

- Combine the bank and statements to match their transactions monthly.

- Always check the fees/interest and separate them to make categorization.

- Regularly review the reports and confirm the balances to match their statements.

Reconciling Accounts After Categorization

You still need to reconcile after you categorize a Credit card payment in QuickBooks. The comparison between QuickBooks and your bank or card statement is used to make it confirm that it matches with every account, which means the Reconciliation. Through this, you ensure that your books are totally correct and there are no charges or payments missing.

Some steps to Reconcile Accounts After Categorize a Credit card payment in QuickBooks are as follows:

- Go to the accounting option for Reconcile by opening it.

- Pick the Credit card to select the account from the bank that you’re checking.

- Enter the details of statements, like the ending balance and the statement date.

- Highlight the categorized credit card payment to match the transactions with other items.

- Make sure that QuickBooks shows a zero in differences.

- Click Save.

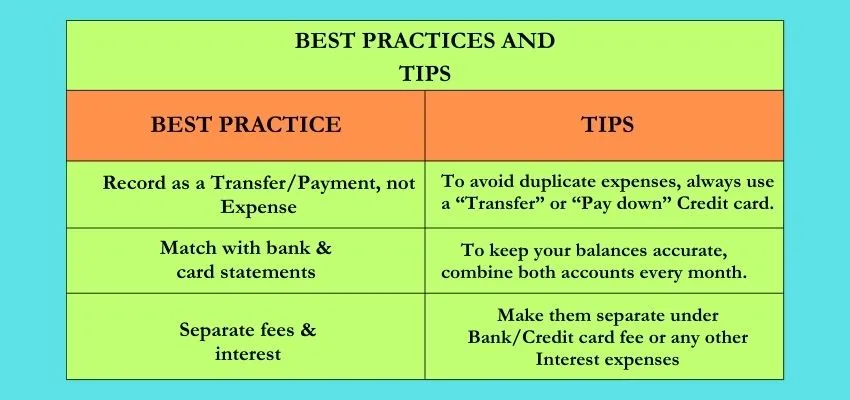

Best Practices & Tips

Alternative Ways to Categorize Credit Card Payments

Including matching, you can categorize a Credit card payments in QuickBooks by making a transfer, or record it as a Check, or expenses from your bank account to ensure that the balances of the Credit card decrease correctly.

Steps of alternative ways to categorize a Credit card payment in QuickBooks are as follows:

- Open the menu button of Banking/Transactions.

- Select the payments from the feeds of your Bank.

- Choose Category/Transfer for selection.

- If you want to use the alternative methods, check/ select the expenses to transfer to a Credit card.

- Press the Add option and save to keep it recorded.

Final Thoughts

At the end of the conclusion, we conclude that, when you categorize a Credit card payment in QuickBooks, it simply means that it keeps the record of all the transfers from your bank to the credit card account. It also keeps your accounts balanced and shows that your payments are still not expenses. Through this, your categorizations get accurate in QuickBooks to ensure clear reports and easier reconciliation for your business.