In the digital era, business is the way in which people build their own frame in the world. There, you need only knowledge about business management. If you are experienced or new in business, then you may know about QuickBooks Online, which is the most popular accounting software run in a web browser. That automates most of the things in accounting management and allows users to access this software from anywhere, any time, and on any device where the internet works.

But do you know which basis of accounting QuickBooks Online uses? If not, then in this blog, we know the QuickBooks Online uses which basis of accounting in detail.

Why QuickBooks Online Uses Different Accounting Methods?

When you buy some raw materials and make some unique things using these raw materials for sale or start providing some unique services for the people’s good, that is called business. So every business has different needs to manage its business and its accounting. QuickBooks always tries to fulfill those needs, which allows users to do their accounting work simply and easily. For that reason, QBO provides different accounting methods that meet people’s needs. The purpose of using different accounting methods in QuickBooks Online is,

- Managing multiple clients from a single platform.

- Preparing taxes.

- Simplify workflow through transaction review and custom reporting features.

QuickBooks Online Uses Which Basis of Accounting to Create a Proper Report?

There are two bases of accounting available first is Cash Basis Accounting, and the second is Accrual Basis Accounting. That helps all businesses to streamline their workflow, tax preparation, and multiple client management. Below, we are discussing these two methods, cash basis and accrual basis accounting, with their advantages and disadvantages in detail.

Details of Cash Basis Accounting

Cash basis accounting is an accounting method that tracks and records financial details of cash flow, like receiving or paying cash, in QuickBooks Online for businesses. It is most of the time used in cash transactions and also in journal entries. It is the best option for small businesses, startups, freelancers, and self-employed persons.

Pros

- It is too easy to use and maintain.

- Anyone can use it without having deep accounting knowledge.

- Track every incoming and outgoing cash movement.

- It always focuses on business cash flows.

- Offers tax benefits

Cons

- Not compliant with GAAP.

- Not useful for large business industries

- Not comprehensive

Details of Accrual Basis Accounting

Accrual basis accounting is a very crucial financial reporting technique. It used to instantly record business income, expenses, profit, and losses as soon as possible. Also, it records every transaction activity, like receivables and payables, including that the payment was made, but the receiver does not get their payment in their bank account.

Pros

- It displays all the financial information with full accuracy.

- If you sell on credit, then it makes the process of tracking revenue easier.

- It can defer your tax liability

- Meets GAAP

Cons

- It was too difficult to use

- It may temporarily hide cash flow issues

- It requires diligent monitoring to avoid potential shortfalls

- Tax timing issues

- Higher maintenance cost

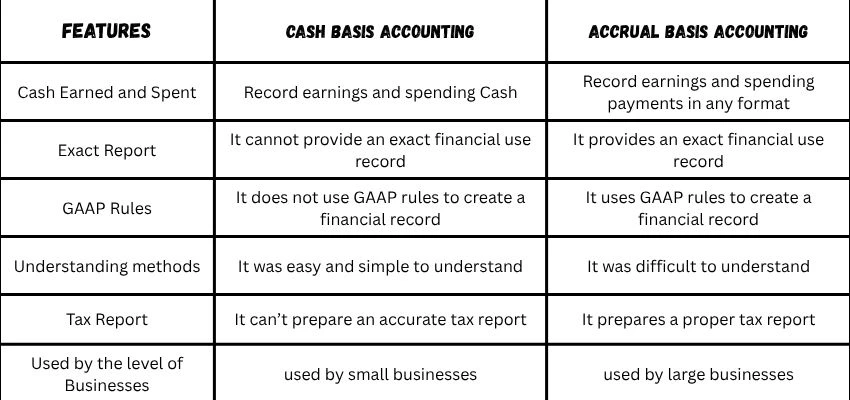

Difference Between Cash and Accrual Basis Accounting

Benefits of Using Different Accounting Methods in QuickBooks Online

By using a different accounting method in QuickBooks Online, you can able to get many benefits that help you manage your business and maintain an exact financial record. Below, we are providing some information on the benefits of using different accounting methods that you get from a single platform, QuickBooks Online.

- Flexibility: It allows users or businesses to choose accounting methods according to their needs.

- Perfect Financial View: When you get the different accounting methods in one platform, then that provides flexibility and ensures an accurate financial report.

- Faster understanding of cash flow: It informs you about your cash flow in real-time, which helps to understand cash flow and also helps to make instant decisions.

- Scalability: It helps to scale your business as you grow and your revenue increases.

Conclusion

Cash and Accrual basis accounting methods make business accounting management simpler and easier. These basic accounting methods are used for different reasons in QuickBooks by Businesses. We hope you all understand deeply that QuickBooks Online uses which basis of accounting.