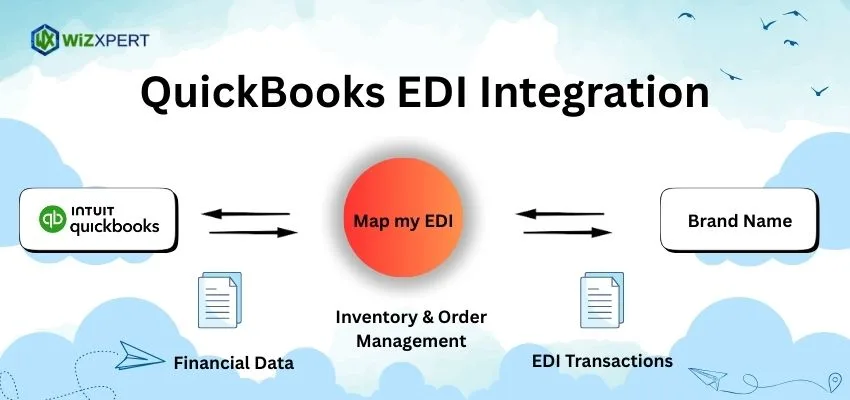

During business hours, QuickBooks EDI Integration helps invoices, purchase orders, and payment details to exchange them electronically between QuickBooks and trading partners. Manual data entry, reducing errors, and speeding up transactions can also be removed through this process. Many business manages their sales, purchases, and inventory by connecting QuickBooks with an EDI system efficiently. Mostly, through this integration, you can improve your accuracy, save time, and make sure to smooth communication with suppliers and customers to simplify the process of financial status.

Things to Know Before QuickBooks EDI Integration

Before you start the topic on QuickBooks EDI Integration, first, you need to know the basics of both QuickBooks and EDI (Electronic Data Interchange). Handling invoices, purchase orders, or inventory updates are some tasks that you need to understand. Check the setup to determine which QuickBooks version you want to use because it may differ from others. Search out your trading partner and their EDI requirements to make sure that you have a stable internet connection, secure storage for data, and an EDI software to make a connection with QuickBooks. To avoid errors, be aware and keep your transactions smooth.

What is EDI?

EDI (Electronic Data Interchange) is one of the digital ways for businesses that is mainly used to exchange important documents, which are directly connected between their computer systems, like purchase orders, invoices, and details of shipping, rather than sending and mailing the papers and attachments. In standard format, EDI transfers information that both companies’ software can read automatically. In short, most companies get help from EDI by sharing business data securely and quickly to make their accurate transactions every day.

Why Integrate EDI with QuickBooks?

In real-time, businesses are allowed to send and receive while integrating EDI with QuickBooks, like invoices, orders, and shipping details, automatically without retyping the data. Through this process, your QuickBooks is kept updated, reducing errors and saving time for manual work. To get faster service and improvement in cash flow, it speeds up the processing of orders for payments and inventory updates. You can handle the growth of your transaction in an easy way to keep your financial records organized.

Requirements for QuickBooks EDI Integration

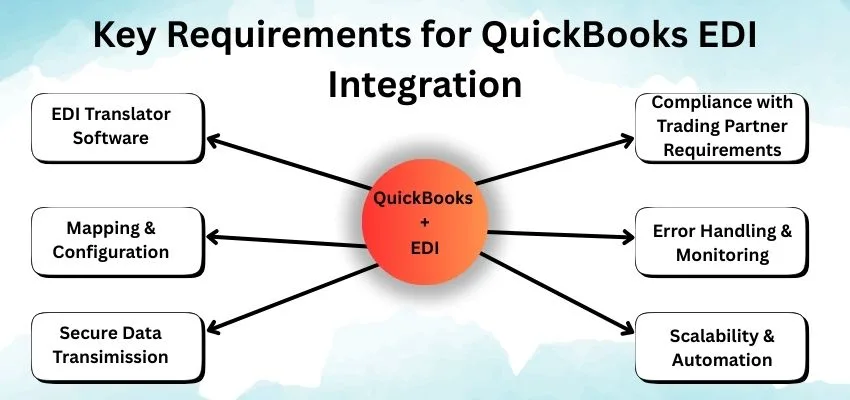

You need a compatible QuickBooks Online version for QuickBooks EDI Integration, which has a trusted EDI software and a stable internet connection for proper mapping, and have access to QuickBooks securely, which are essential. Be sure that your team already has a basic knowledge of accounting workflows and EDI formats. Through these requirements, you can ensure your business runs smoothly and accurately for exchanging documents.

- Here are some steps of the major requirements of QuickBooks EDI Integration mentioned below:

- Always check to confirm the QuickBooks Online and Desktop version to get support for EDI.

- Choose a stable internet connection service for the EDI provider.

- Make a setup to provide access to enable the Web Connector.

- Make a plan for matching the data of EDI documents to QuickBooks.

- Prepare your team members to take a test trial to run your transactions.

How to Integrate EDI with QuickBooks?

Before going live, take a sample test for transactions to ensure accuracy during QuickBooks EDI Integration. Choose an EDI provider to connect QuickBooks and map EDI documents securely to get matched with QuickBooks fields. Through this process, exchanges of order automate the invoices and shipping details to save time and reduce the errors of manual entry.

Here, we discussed a step-by-step process of QuickBooks EDI Integration in the following ways:

- Pick a trusted EDI service to select a provider.

- Provide access to Web Connectors to set up QuickBooks.

- Align the EDI documents for mapping the data in the fields with QuickBooks.

- For a normal test, take a sample of trial transactions and data for accuracy.

- Allow the application to go live and track to monitor the performance.

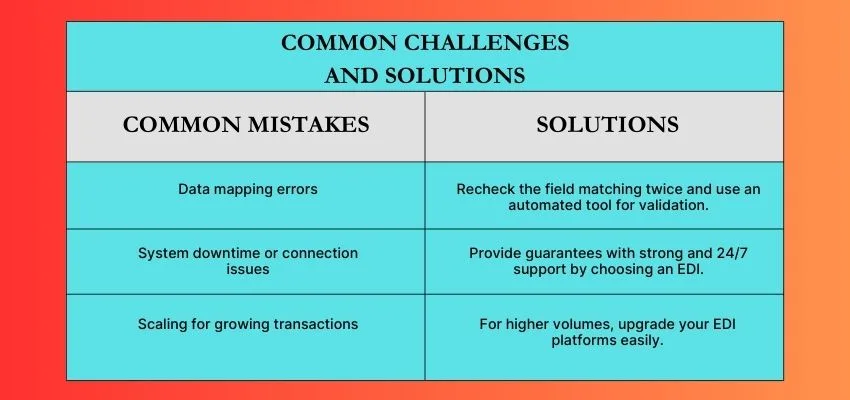

Common Challenges and Solutions to Fix Them

Best Practices

Always try to keep QuickBooks and EDI software updated to make them smooth for QuickBooks EDI Integration. Regularly back up data and take tests of the workflow to catch the issues. Prepare your team and provide them with training on EDI processes and security rules. Maintain strong passwords or two-factor authentication to avoid errors, always monitor your transactions, and protect data. Through these practices, you can ensure efficient EDI operations by making them accurate and secure.

Cost Considerations

There are different types of costs available in QuickBooks EDI Integration, including setup fees, monthly provider charges, and custom development expenses. Prices mostly vary in service types and transaction volume. To get an overall return on investment, it makes your processing limit faster and reduces errors.

Conclusion

At the end of the conclusion, we conclude that QuickBooks EDI Integration always works faster and with fewer mistakes. It sends and receives orders, invoices, and shipping details automatically to save time and money. While integrating EDI with QuickBooks, companies can handle more transactions with accurate provider and set up to improve the flow of cash in QuickBooks to run their operations smoothly.