In the era of accounting and finance, as a small business owner or an accountant, you can make search for how to edit chart of accounts in QuickBooks Online to stabilize your charts of accounts. You can edit chart of accounts in QuickBooks Online by using the default method, which will never allow you to edit the detail type on the chart of account. This would make you frustrated with the waste of time, which may be better spent on something useful.

Only admins have access to make changes. Always remember to avoid mistakes, export your data before editing. For adding or deactivating, make a plan to keep records accurate and organized. In this blog we will discuss how to Edit Chart of Accounts in QuickBooks Online.

What is Chart of Accounts in QuickBooks Online?

In QuickBooks Online, the charts of accounts are one of the lists which was completed for all financial accounts in businesses used to categorize the transactions, including assets, liabilities, income, expenses, and equity accounts. It helps to track your financial data just like a roadmap to locate where your money is coming from and where it is going.

When you start using QuickBooks Online, it makes you sure that the created chart of accounts of your financial reports is accurate and structured properly. Through which you are allowed to generate or create reports quickly and efficiently, like profit and loss statements, balance sheets, and reports of cash flow.

Why You Need to Edit Chart of Accounts?

You need to edit chart of accounts in QuickBooks Online to keep your financial records organized, accurate, and useful. While your business grows or changes, it requires new accounts, for which you have to add new products, services, or departments. You are allowed to remove some accounts that have already become unnecessary to avoid confusion. You can easily understand by ensuring it that your financial statements stay clear. In short, while edit chart of accounts in QuickBooks Online, it keeps your bookkeeping organized and aligned with your business goals.

Steps to Edit Chart of Accounts in QuickBooks Online

To edit chart of accounts in QuickBooks Online is just like making changes to the list of all your income, expense, and liability accounts. Before keeping it accurate, make sure that your financial reports are clear and easier for tax prep. Whenever your business changes or finds some duplicates, you can quickly edit the names, types, and details of the account.

Here, we have discussed the full procedure to edit chart of accounts in QuickBooks Online in a step-by-step method mentioned below:

- Log in to your account in QuickBooks Online.

- Go to Settings for the chart of accounts.

- Look over the accounts and press the dropdown to edit them.

- Change the details of the name or description for the update.

- Choose the inactive option to remove the account.

- Click Save and Close it.

- Make a review to check out the reports.

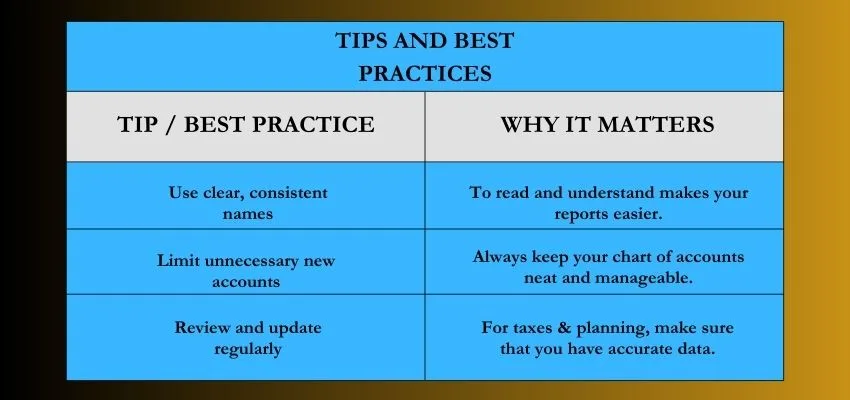

Tips and Best Practices

To create too many new accounts, use sub-accounts to avoid and keep account names clear and consistent when needed, so that your reports will stay easy to read. To keep your financial records accurate and catch your errors, review the edit chart of accounts in QuickBooks Online regularly.

Common Mistakes and Cause of the Problem

People may sometimes change an account type by mistake, which can have an effect on your record while you edit chart of accounts in QuickBooks Online. When others forget to back up or merge chart of accounts in QuickBooks Online accidentally, both actions can create confusion in financial records, and they are hard to undo. Here are the common mistakes you can know the problem and then solve them to fix the issues.

Conclusion

At the end of the conclusion, we conclude that, in QuickBooks Online, editing the chart of accounts mostly keeps your financial records organized and accurate. When your business changes in QuickBooks, make sure to update the reports regularly and correct your taxes. Always check accounts carefully to maintain them with a clean and easier-to-understand format, and lists of accounts for better decision-making.