Working as an accounting or finance manager, it could be right for you to manage a business’s finances if you would like to take on a role to help. A business stays financially stable by helping both of them to share their similarities. The two roles have some key differences from each other. Like responsibilities, work environment, education requirements, and salaries, these two have their own different roles. In this blog, we’ll guide you through the process of what an accounting manager vs finance manager is, with their responsibilities and their overviews.

What Do You Mean by an Accounting Manager?

An accounting manager is the one who leads the whole accounting team and, individually, handles and maintains the financial records, generating reports, establishing internal processes, and assigning tasks to the team. In implementing policies, an accounting manager is the one who is in charge of procedures by ensuring accurate work. From the accounting department, an accounting manager maintains the activities day-to-day.

Responsibilities of an Accounting Manager

- Here, we’ve discussed the responsibilities of an accounting manager in steps, as in the following ways:

- Keep the financial data by recording, analyzing, and evaluating it.

- They work with executives to make informed financial decisions for lower production costs, creating a plan.

- Regularly track and monitor the expenses, sales, and revenue.

- Using available data on the company’s financial status, create budgets for the company.

- First, make sure that the company can adhere to the budget, then manage financial processes.

- Offer further instructions and feedback, and maintain their work with delegated tasks to the accountant.

- To ensure efficiency, regularly analyze the procedures of accounting departments.

- Always recruit and train new employees.

What Does a Finance Manager Refer to?

A finance manager is someone who can operate or handle the whole management of the finances of an organization and helps to make sure that the supportable of finances. To achieve the milestones, they help organizations with long-term financial goals and build comprehensive strategies by reviewing them. The investment decisions and activities of a company can be easily managed or operated by a finance manager. To determine effective strategies, they run, analyze, and interpret various data to improve their financial health of a business.

What are the Responsibilities of a Finance Manager?

- The responsibilities of a finance manager need to be known while working are mentioned in steps in the following ways:

- To maintain financial reports and also create them.

- Manage and analyze the financial data with budgeting.

- With financial regulations and standards, ensure compliance.

- Developing and implementing those financial strategies that are aligned with the objectives of your business.

- Take risks to make informed decisions for forecasting financial trends and access.

- Maintaining and tracking the performance of financial management and transactions.

- Manage teams to prepare them for financial statements, tasks, etc.

- Provide your team members with training, recruitment, and support.

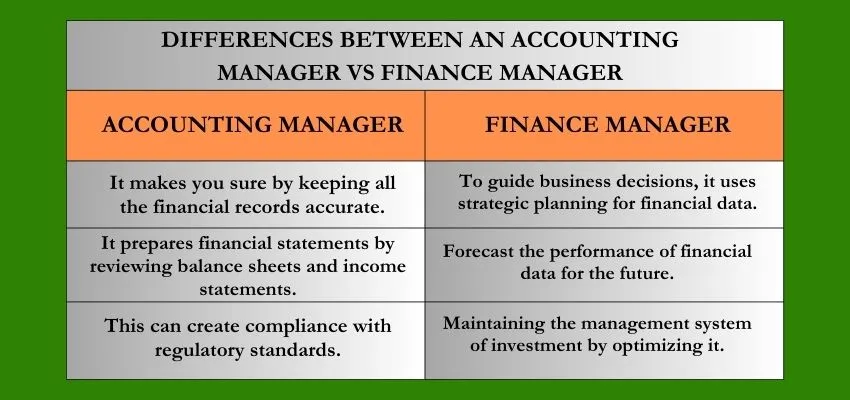

Difference of Finance Manager and Accounting Manager

Here, you can easily enhance your business by taking the help of an accounting manager and a finance manager. So, it is most essential to know the difference between finance manager and accounting manager. Below, we’ve discussed the differentiations between the managers. Just follow the steps mentioned below:

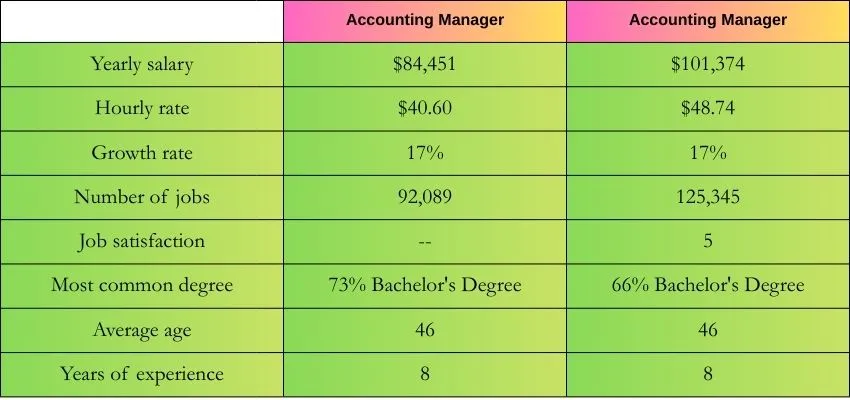

Overview of Accounting Manager vs Finance Manager

Here, we’ve mentioned an overview of the accounting manager and finance manager, including their finance manager vs accounting manager salary for the year, hourly rate, etc.

How to Choose Between an Accounting Manager vs Finance Manager?

Deciding between an accounting manager vs finance manager, your business requires you to focus on daily operational tasks by assessing your needs to set up and determining a more strategic approach to financial management. In this process, defining responsibilities clearly is the first step. By business owners, such key questions should be asked: To manage routine operations, like payroll, accounts payable, and financial records, do I need someone? Or was the guidance on financial strategy and planning seeking the business for the long term?

With your overall business direction and support for sustainable growth, the cost consideration, future aspiration, and evaluation of your current stage will help you to ensure the chosen role.

Key Similarities of Accounting Manager and Finance Manager

- To interpret financial data, identify trends, and assess financial performance, both accounting and finance managers require strong analytics skills.

- To develop financial projections, which are based on the historical data and future goals, both managers are involved in this budgeting process to complete this by providing help.

- To evaluate the financial health of the company, they use core accounting principles, like assets, liabilities, and expenses, to analyze the financial statements by the accounting manager and the finance manager.

- Through careful management, both the accounting and finance managers decided to improve their core by ensuring the company’s financial health and stability.

Conclusion

At the end of the conclusion, we conclude on the topic “accounting manager vs finance manager” that both of them have their vital role for the organization. For your business, they safeguard the financial health by maintaining accurate financial records and help you to make informed decisions. They have the necessary experience, expertise, and knowledge of the accounting systems to manage and maintain your financial health and satisfy regulatory compliance requirements.