Saving enough for the future is a vital part of everyone’s financial plan, so retirement plans have become more important. You can keep your payroll and employee benefit records accurate with the help of categorizing 401 (k) contributions in QBO to manage the retirement plan. For tax and reporting, it ensures each contribution is tracked correctly or not, whether employee-deducted or employee-funded. You can simply reconcile the payroll by assigning the right expense and liability accounts to maintain clean financial statements. You can keep your financial books organized and manage retirement benefits more easily by learning this process.

If you want to try this new feature, then you can install the QuickBooks Online demo and trial on it. In this blog, we’ll guide you to learn how to categorize 401(k) contributions in QuickBooks Online easily and quickly.

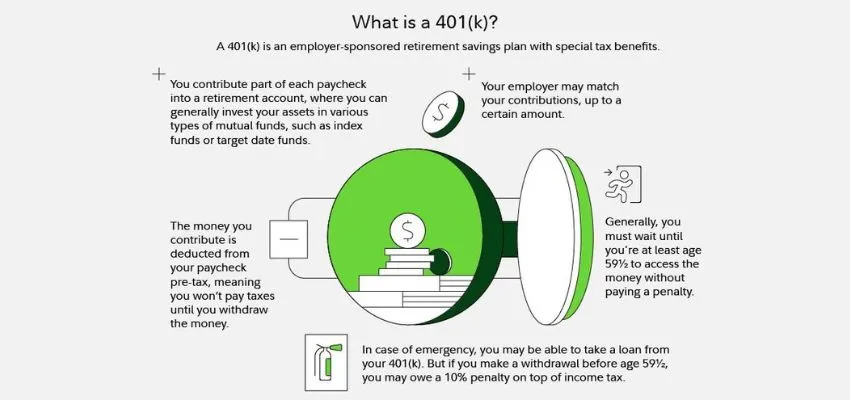

What do you mean by 401(k) Contributions?

A 401 (k) is a retirement plan that provides tax benefits offered by an employer. The limit of this plan is set by the contributions deducted from the employee’s salary. The money invested in this 401 (k) plan can grow tax-free over time. This invested money is kept as savings which employee gets after their retirement.

Types of 401(k)

There are two main types of 401(k) plan available. Here we’ve discussed the types of 401(k) plans with their explanation, as in the following ways:

- Traditional 401(k) Plan

- Roth 401(k) Plan

Traditional 401k Plan

This traditional 401 (k) plan is referred to as a pre-tax 401 (k) plan because employees contribute pre-tax dollars from their salary to this plan. The money that you put into this plan doesn’t require tax to be paid, but you have to pay tax when you want to withdraw your amount.

Roth 401k Plan

In the Roth 401 (k) plan, you have to pay tax on what you are saving and the dollars of tax in your account. The benefit you get in this plan is that you won’t need to pay any tax when you withdraw your savings.

How to Set Up Accounts 401(k) Contributions in QuickBooks Online?

Here, we have discussed some basic instructions with steps for setting up the accounts of 401(k) contributions in QuickBooks Online, as in the following ways:

Access and Sign up for Accounts

- Register with your QuickBooks Online account by using your detailed information.

- Click on the “Employee Centre Tab”.

- Select the “Mark” option to locate the central hub in the dashboard.

- Go to the employee center, find the section labeled “Retirement Plan”.

- Press the “Proceed” option to allow the setup.

- Click on the “Types” option and choose the types of retirement plans.

- Click on the option “401(k) plans”.

- Including the plan name, effective date, and any other relevant information, add the complete details of 401(k) plans.

- Configure the employees’ contributions amount and match them.

If You Have a Specific 401(k) Plan Provider or Vendor

- Enter the specific necessary details. Click the “Integrate” button to link them with QuickBooks Online.

- Choose a provider or a vendor for seamless integration.

- Enable the feature of enrollment for your employees for easy sign-up for a 401(k) in QuickBooks Online.

- Before finalizing the setup, review the information properly and confirm it.

- At last, click on the Save option to make it permanent, then close it.

Steps to Categorize 401(k) Contributions in QuickBooks Online

When you are planning for retirement plan, having the right accounting software to partner with is vital, which makes a significant difference in managing accounting tasks. Here, QuickBooks Online comes with a 401(k) feature that helps you succeed in your retirement plans.

- An accurate retirement savings plan and perfect financial records are important to categorize 401(k) contributions.

- A specific 401 (k) account and an expense account are needed to record the contributions.

- These transactions should be entered as expense transactions, giving a detailed description of the employee information.

- After this, it is important to reconcile all this information to maintain accuracy.

- Regularly examining the contributions helps you to maintain a clear and compliance with rules and regulations.

Pros and Cons of 401(k) Contributions in QuickBooks Online

A 401(k) contribution plan has its own pros and cons that can benefit your business in both ways. Let’s discuss in brief to get a clear picture of 401(k) contributions.

Pros

- While you save your tax burden for retirement, a traditional 401(k) allows you to reduce it.

- The qualifying withdrawals become tax-free with a Roth 401(k).

- Employers follow the 401(k) plan by which allows the tax to be put off slowly.

- Contributions are automatically deducted from your salary, so it stays hassle-free.

- This plan boosts your savings for retirement, and an employer match is needed to follow these 401(k) contributions in QuickBooks Online.

Cons

- The required minimum distributions (RMDs) are generally subject to the Traditional accounts, not to Roth accounts.

- If you have never qualified for the hardship withdrawal and you are still younger than 59, then the penalties of 10 % you need to pay to the IRS.

- 401(k) is still typically average, so it can come with fees.

- Depending on your goals and circumstances, a 401(k) is not enough on its own to maintain you in retirement. Just imagine that you are talking with a financial professional who can guide you through other options.

Conclusion

We hope this guide on 401(k) contributions in QuickBooks Online meets all your requirements. Setting up and categorizing 401(k) contributions accurately in QuickBooks Online can be a game-changer for employers as well as employees. However, you have an interest in knowing more about 401k plan, then connect to our QuickBooks ProAdvisor.