Every business owner has to spend a lot of money on buying raw materials for production. While manually adding all these Transactional details to the record, you may wrongly interchange the digits in the amount. It is also known as a transposition error in accounting software. Due to this error, the owner will face difficulty in getting a perfect financial and tax collection report. These transposition errors are common when a user manually enters data into a record, which may lead to incorrect visualization of the business working process.

In this Blog, you can learn about the transposition error in accounting and how to solve it easily.

What is a Transposition Error in Accounting?

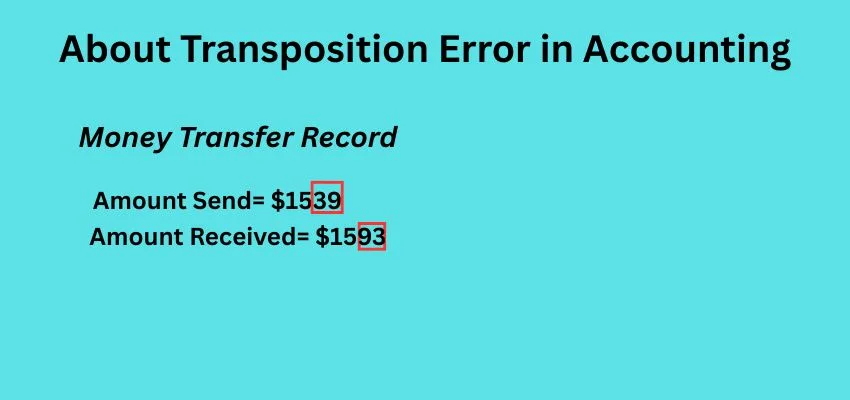

Think of a situation where you are entering the transaction data manually into the record, and you replace a digit incorrectly. It is known as a transposition error in accounting. This type of error mainly leads to an inaccurate financial report of the business. Because of it, you may add the wrong amount to the employee’s monthly wages.

This mistake may lead a business to face a financial problem. Because of wrong data, you may not properly create a tax report for the business. This type of error occurs not only in the accounting process but also while putting in the phone number, product serial number, or the address. The main reasons behind the occurrence of transposition error in accounting are:

- Manual Entry: It mainly takes place when you try to enter the number or other information manually, and you wrongly swap the data.

- Data Copying: An Error can occur when you are copying the data from one system to another when it is entered manually.

- Lack of Control: Because of a lack of control, this error was entered into the sheet without being caught.

Problems Faced Due to Transposition Error in Accounting

Every accounting manager wants a perfect record that contains correct data to properly calculate the financial records. Due to the manual entry, wrong data will be added to the record, which may lead to some problems that are faced due to transposition errors in the accounting process.

- Wrong data in the financial record may lead to the creation of an incorrect balance statement to pay wages to an employee.

- Wrong financial data will lead to a wrong tax calculation amount, so you have to pay the fine to the tax office.

- A perfect decision can be taken with the perfect financial record. The wrong data may lead to taking the wrong decision for the business.

- Incorrect data in business may lead to the creation of fraudulent activity. It will affect the business’s reputation in the market.

- While correcting the wrong data, there will be a lot of waste of time, which could be used to decide on the business success.

How to Find the Transposition Error in Accounting?

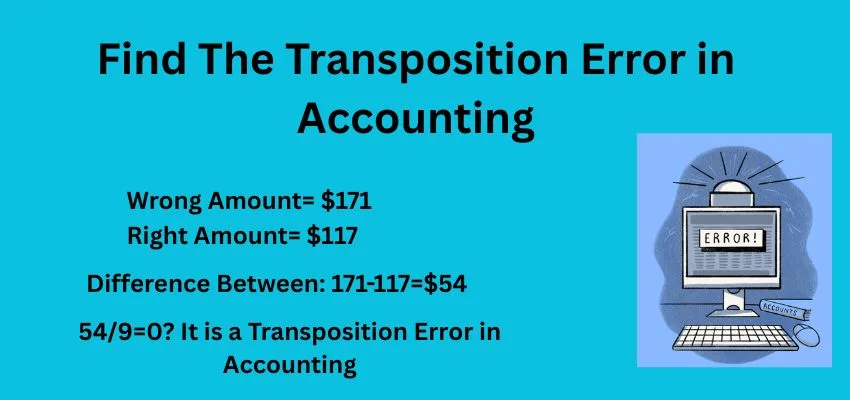

While collecting the trial balance, you can know about the transposition error in accounting, as it creates a difference in the amount between the debit and credit accounts. You can use a simple calculation first, find the difference between the incorrect balance and the correct balance. If the result of the subtraction is divisible by 9, then it is a transposition error in accounting.

Example:

Wrong Data: $171

Right Data: $117

Find the difference between the wrong and the right data: 171-117=54

Whether the resulting data 54 is divided by 9 or not?

Yes, 54 is divisible by 9, so it is a transposition error in accounting.

How to Fix the Transposition Error in Accounting?

Transposition error in accounting may create lots of problems in the business growth procedure. So you need to solve this error so that it will not create many problems in the business working process. You have to follow a simple procedure for it:

- Recognise Error: After checking the actual data and the wrong data. If the difference is divisible by 9, then it is a transposition error.

- Incorrect Data: After knowing the transposition error, search for the incorrect data. You can check if you have wrongly interchanged the digits or made any other type of mistakes.

- Solve the error: Rectify the data by creating a new record with all the correct details. If it’s been posted, then you have to go back and correct the error.

- Check & Confirm: After correcting all the data, you have to check all the entered amounts correctly and make sure that the debit and credit accounts have the same data.

Prevent this type of Error

Transposition error in accounting can adversely affect the business’s financial goals by giving wrong data. In the future, this wrong report may affect the stockholder’s impression, business partner, or the financier. So to prevent this type of error in the future, you have to follow some common procedures:

- Automatic Process: Use the accounting software for automatically entering the transaction data that prevents human error and saves the employee time.

- Record Data: Collect the transaction data in 2 accounts simultaneously to find and rectify the error properly.

- Matching Data: Continuously check the recorded data with the bank account to identify errors and solve them properly to prevent this in the future.

- Employee Training: Give training to employees to properly check data after entering it in the record.

Conclusion

Transposition error in accounting can hurt the business’s financial report by giving wrong data, which creates a problem for the business. You have to solve this transposition error by properly checking the record with the debited account. So that the accounting process can create a proper tax report to prevent fines on the business. It also allows the owner to get a detailed view of the business condition and take important steps to enhance the business growth process.