Customers and Finances can be managed by businesses with the help of two powerful tools, named as Insightly and QuickBooks. While QuickBooks handles both accounting and bookkeeping, at that time, Insightly organizes sales, projects, and contacts. Integrating Insightly with QuickBooks creates a smooth workflow to sync automatically with customer data, invoices, and payments. Insightly is one of the popular CRM (Customer Relationship Management), that improves efficiency, saves time, and reduces errors by allowing the whole team to focus on the growth of manual entry in business.

In this article, we’ll discuss with you the step-by-step process of “Insightly QuickBooks Integration” quickly and exactly.

What is Insightly QuickBooks Integration?

For creating a seamless workflow account, Insightly QuickBooks Integration connects itself with your CRM and accounting system. Generally, through this Integration, details of customers, invoices, and payments are automatically synced between CRM and accounting platforms. Accountants are getting their accurate records in QuickBooks, while in Insightly, the sales team can see the total financial data directly without any manual entry. Many businesses were gaining their better visibility performances into sales, project costs, and revenue by reducing errors, saving time, and keeping the data. The integration helps teams to collaborate by linking a customer relationship with financial insights.

It also provides you with a clear image of your customer from their sales history by reducing errors, saving time, and manual data entry in financial transactions. In short, it is a combination of sales and accounting data that makes the process of businesses smoother and improves decision-making.

Key Features of Insightly QuickBooks Integration

The Insightly QuickBooks Integration is a joint data of customer relationship management and accounting, which allows users to sync between two platforms to view QuickBooks invoices, Payments, and data of contacts automatically within Insightly. To track the project expenses, the user can view the inside financial data of Insightly to generate exact invoices from opportunities. It makes an improvement in decision-making, reduces duplicates from the original works, and ensures the actual timing for data accuracy. It also supports customer Insightly better by combining sales, projects, and financial details in one place to smooth the operations.

Steps of the key features of Insightly QuickBooks Integration are as follows:

- In both systems, Customers and vendors get updated automatically for syncing contacts.

- For the management of invoices, it creates and sends them directly from Insightly.

- By tracking your payments, you can view their payment status and history in Insightly.

- With QuickBooks records, add the project costs to the link for expense tracking.

- In real-time, always keep the data updated and avoid duplicate entries.

- For Insights, combine sales, projects, and financial data to make better decisions.

Benefits of Integrating Insightly with QuickBooks

Some basic benefits of Integrating Insightly with QuickBooks are in the following ways:

- Double data entry is not allowed to save time.

- Errors get reduced by syncing automatically to ensure accuracy.

- It quickly generates invoices.

- A better monitoring system to track payments and expenses easily was present in it.

- Sales and finance data are combined to provide a clear view.

- For the growth of Insights, it uses smarter decisions.

How to Integrate Insightly With QuickBooks?

Set up the requirements needed while enabling integration, linking accounts, mapping fields, and testing transactions can be done to simplify the payments flow, by connecting the two invoices and expenses.

Here, we have discussed the process in a step-by-step that how to integrate Insightly with QuickBooks as follows:

- Sign up with your Insightly account.

- Go to the System Settings and open Integration.

- Then, select the QuickBooks Integration button.

- Click the connect option to make a connection with QuickBooks, and again sign in to QuickBooks.

- Provide permission for Insightly to have access to QuickBooks.

- Set a field for mapping with customers, invoices, and payments.

- Lastly, save the settings and take a normal test by syncing with a sample record.

Best Practices for Using Insightly QuickBooks Together

Depending on getting more from the Insightly QuickBooks Integration, you need to keep your data always updated and sync regularly. Train your team to have the capacity to use both systems effectively by clear rules for invoices, payments, and contacts. To review reports, it has the best automated tracking performance, where tasks are maintained clean and smooth, the workflow for duplicate-free records, and also for making better decisions.

Now, we’ll discuss briefly some steps of best practices for using Insightly QuickBooks Integration together, which are given below:

- Keep your data updated by syncing regularly in both systems.

- Set rules for the flow to make decisions on invoices, payments, and contacts.

- Train your team perfectly, so they are capable of using the tools.

- Always keep tracking your sales and even finances to review the reports anytime.

- Using the automatic system saves time on tasks.

- Always keep removing the duplicate manual entries to get clean data accuracy.

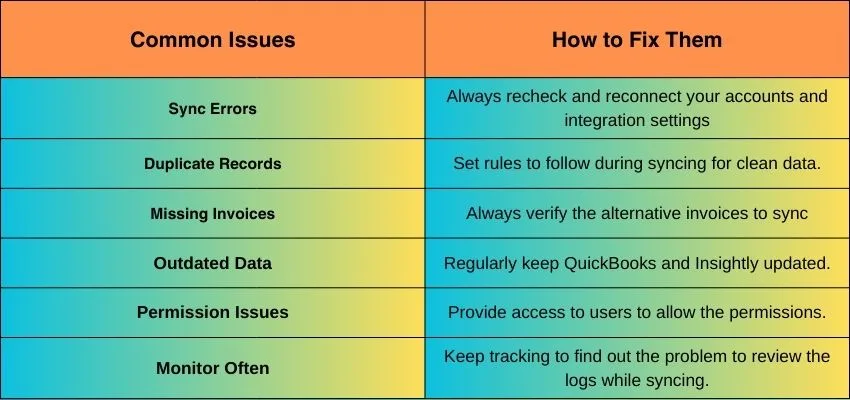

Common Issues and How to Fix Them

Alternatives & Add-ons

Mostly in businesses, users try alternatives like Zoho CRM, Salesforce, or HubSpot with QuickBooks rather than using the Insightly QuickBooks Integration. And add-ons, including Zapier, Integromat, and Pie Sync, also automate the workflow. By syncing with these tools, contacts, invoices, and payments smooth the operations without depending on Insightly’s built-in integration.

Below we have discussed some alternatives and add-ons in steps as follows:

- Pinpoint your needs for businesses.

- Select an alternative to CRM (Zoho, Salesforce, and HubSpot).

- For automation, use add-ons like Zaiper, Make, and PieSync.

- Connect the QuickBooks account with your CRM.

- Sync with the tools like contacts, invoices, and payments.

- For more efficiency, customize your workflow to smooth the operation.

Conclusion

At the end of the conclusion, we conclude that business management simplifies the Insightly QuickBooks integration by connecting the data of customers with their finances to make improved decisions, keep records exact, and reduce manual errors. Making it a practical business efficiency, the integration ensures the growth of business operations by using QuickBooks. While Insightly QuickBooks integration best accounting software to smooth the finances and also handle both accounting and bookkeeping, to make use of the business.