Multiple key differences specifying a sales receipt, bill, invoice, and statement in QuickBooks are different from each other. We are here with this blog to give information about these all so that you can properly enter these transactions in QuickBooks Online. Go through the page you will get all the definitions arranged in order to provide you with a better understanding. For more details connect with us through Toll-Free: +1-844-405-0904

There may be some confusion between invoice and statement terms at the time of dealing with credit card providers since they issue a statement that is actually an invoice. In the same way, invoices and a bill, both are documents providing the same information about the amount owing for products or services. Invoices are used by businesses to collect money and users treat the invoices as a bill to pay.

Many QuickBooks users have shown interest that they want to know the difference between invoice and bill, and invoice and statement separately. In this article, we have also covered a short difference between invoice and statement as well as invoice and bill topic to help all the users who think the same. We respect your valuable time, so continue your reading by stay connected with us.

Table of Contents

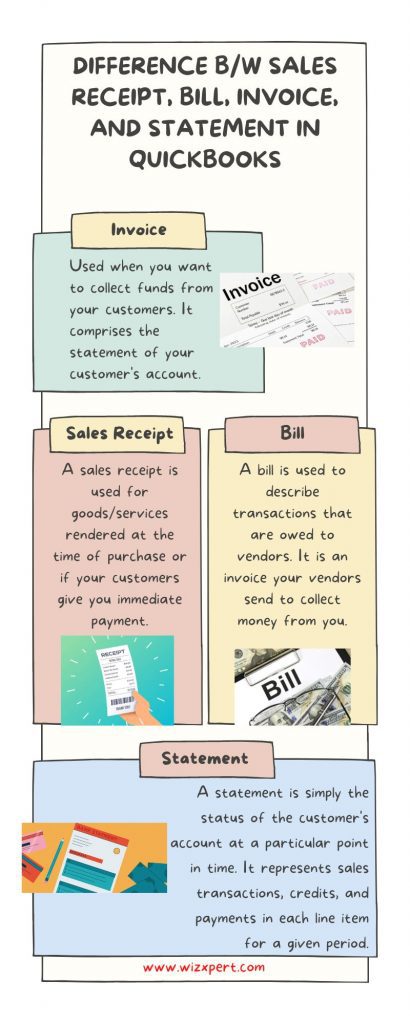

Difference Between an Invoice, Sales Receipt, Bill, and Statement in QuickBooks

Here we have discussed fewer differences between invoice, sale receipt, bill, and https://www.wizxpert.com/how-to-set-up-sale-tax-in-quickbooks/statement in QuickBooks Online. You will get answers to all queries you keep in your mind. To fix the queries instantly proceed with the article. Read the below information to know about it completely.

What is an Invoice?

Do you know what an invoice is? An invoice is an accounting documentary issued by a business for their clients that defines both the product and services provided and details the amount of money that you owned to work. An invoice can be created when you want to collect information from your customers. An invoice will help you to do the following listed below:

- It is a business transaction that you create to request payments and to receive money from your clients.

- It is a business transaction sent to your clients who have not paid yet when specific work items or goods/services sold are finished or completed successfully.

- An invoice is issued before getting the payments and also you have to request payment by a specific deadline.

- An invoice is an individual sale transaction that partially comprises a statement of your client’s account.

- An invoice generates a record of both goods and services sold along with that, storing records for recordkeeping purposes.

What is Sales Payment?

You use sales payments for goods and services provided at the time of purchase(generally it is referred to as a ‘point of sale’ purchase) or if your client clears all the payments immediately.

What is a Bill?

Do you know what a Bill is? A bill is a business document specifying the amount owed by the customer or goods or services provided, it prints or writes in the form of statements of the charges. Bill also helps in describing transactions that are owed to suppliers.

- A client is eligible to issue a bill before sending the payments

- When you receive an invoice from a supplier as a customer, you treat it as a bill and also mention it in your books for paying timely.

- It is an invoice sent to the suppliers from you just for collecting money.

What is a Statement?

A statement is nothing, it is the status of the client’s account at a specific point in time.

- It shows sales transactions, credits, and the payment in each line item for the time given, it is unable to offer you more details as same as individual sales transactions.

- The statement helps to notify your clients where they stand and if they still want to owe you any money. Even, you are eligible to send it to the customers every day, it is up to you.

A Short Difference Between Invoice and Bill

An Invoice and Bill indicating similar details about the amount owed come inside the business transaction and can be treated as the document. But the invoice is generated by the business providing goods/services whereas when the customer receives invoices records, treats it as a bill to be paid.

A Short Difference Between Invoice and Statement

An invoice will document the particular sale transaction where both goods and services are given to the buyer, where a statement considering all the invoices that are recently not paid(due) by the buyer. This will result in you in fewer differences listed below:

| S.No | Invoice | Statement |

| 1. | The role of an invoice is to collect the payments for their specific sale. | A statement is more of a general notification of nonpayment. |

| 2. | Invoice helps you to provide detailed information on your specific sales including item description, item price, shipping charges, and sales taxes. | A statement helps you to provide a grand total due for each invoice. |

| 3. | Once a sale has been completed, you are eligible to issue an invoice. | A Statement is only issued when at set intervals such as at the end of the month. |

| 4. | When an invoice is received, a buyer records a payable, and also records no accounting transactions at all when a statement is received. | The statement is informational in behavior. |

This is hasty to use a statement in place of an invoice and pay items that were listed on the statement, there may be chances that the buyer was already paid for those items, but the payment is not reflected in the seller’s accounting system. So we highly recommend you(if you are a buyer) to make inquiries about any invoices that are listed on the statement and obtain the complete information before issuing the payments.

Wrapping Up

Hope we successfully resolved all your queries that match with the issues based on invoices, sales receipts, bills, and statements in QuickBooks Online. But if the query still blocks your path, then move to our Intuit Certified ProAdvisors who have advanced knowledge and are capable of clearing all your confusion based on the difference between an invoice & bill and invoice & statement in QuickBooks. Connect instantly by dropping a call on our toll-free number discussed above. If you are unable to reach us through a calling facility then adopt a live chat service to get faster responses with our expertise.