Learn here in this article to close a books & company in QuickBooks Desktop & Online. The article here is to describe the benefits, and the process to close a books & company in QBD & QBO. With the help of QuickBooks, you can organize your business. It provides many features, closing the books or company is one of them. In this feature, you can close the books at the end of the year. Go through the complete article to get all your queries resolved, For more info contact our QuickBooks ProAdvisor toll-free: +1-844-405-0904

In this article, we’ll show you how to close a company as well as books in QuickBooks Desktop, Pro, and QuickBooks Online.

This QuickBooks feature is the accounting process of zeroing out your Income and Expense accounts and recording the company’s Net Profit or Loss into the Balance Sheet. Before you begin using QuickBooks for your accounts, you need to create an opening balance.

Benefits of closing books or company in QuickBooks

Once you create new company data it will affect the previous balance sheet. So we use the close of the book, the main purpose of this is to protect the transaction. To use this feature you need to set a closing date and password command in QuickBooks. That will lock down all information so that it can not be affected by your business.

How do you Close the Books in QuickBooks Pro?

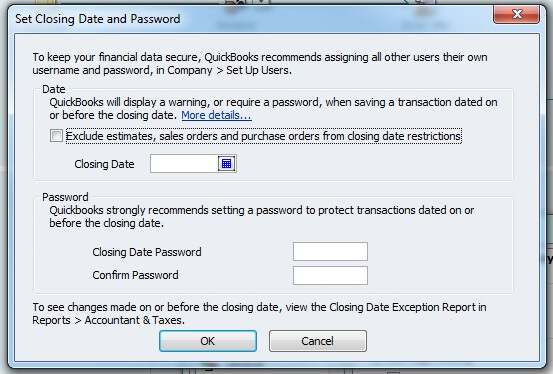

This is carried out with the aid of putting in and requiring a password to edit transactions beyond a specific date. Each master and corporation directors can set the ultimate date and password:

- Select the Gear sign-> company setting

- Select Advanced

- Click on the Edit icon, in the Accounting section.

- Select to mark the Closing The Books checkbox.

- Enter a closing date. Transactions dated on or before the closing date cannot be modify without warning.

- Decide what you want users to see if they try to save a transaction that is dated prior to the closing date:

- Select Allow changes after viewing a warning to make a warning message appear.

- Select Allow changes after viewing a warning and entering a password to make the user also enter a password. Then enter the password in the two password fields below.

- Select Save for Done.

View the changed transaction after the closing date:

You might need to track some transnational changes details even after the closing date.

- Click on Reports from the menu on the left side.

- Choose Accountant Reports and Taxes.

- Tap on Closing Data Exception Report and view the required reports.

- In this report, you can see the closing dates and the user who set the closing date.

Can we make any changes after closing QuickBooks Books?

If you want to preserve the integrity of your financial data in QuickBooks then there is no need to make changes to QuickBooks after you have closed the QuickBooks. So it‘s good that you don’t make any changes to Quickbooks after closing books.

However, if you forget to enter a transaction and you want to make changes in a transaction in closing files, you need to enter the password to proceed further. This would be of great use for security purposes.

How to close the Books in QuickBooks online

You just have to follow the steps discussed above under the heading how to close the book in QuickBooks pro. So no that’s all you need to do. At the end of the year, QuickBooks automatically close out files and reports all losses and expenses. You don’t have to worry about everything manually.

How to Close A Company in QuickBooks Desktop?

In QuickBooks Desktop, you don’t have to worry about closing the Books at the end of the financial year. QB Desktop will automatically adjust the opening and closing balance in order of preparation for the upcoming year.

Adjustments made by QuickBooks at the end of Year

According to the starting month of the financial year QuickBooks makes some changes. These are the adjustments that QuickBooks automatically make.

- To make zero net income in the upcoming fiscal year, QuickBooks made changes into the income and expense accounts in a way so that the outcome is zero.

- QuickBooks also makes adjustments in the net income entry. For Example, if your previous year’s profit was $12000, then QuickBooks enters a $12000 net income on the last day of the financial year. This can be visible in a line of the equity section.

- On the first day of the next financial year, QuickBooks increases your Retained Earning Equity by the same amount as the previous fiscal year’s net income ($12000) in this example and decreases the net income by the same amount. By doing this, your net income at the start of the new financial year will be zero.

Advantage of closing Books in QuickBooks

- Restricted Access: One of the reasons why you should close the books in QuickBooks is you can restrict other users from accessing the previous accounting data including the transactions. You can create a closing password to enable this QB feature. After doing that, only the user with closing password and authority will be able to modify or delete transactions from the closed period.

- Reporting: The changes that are made after the closing date to the transactions dated on or before the closing date will appear in the Closing Date Exception Report.

Disadvantages of closing the Books

- It won’t be easy to access the previous year’s transactions. If needed then, the user will require closing date password and authority as well.

- Without the permission of the user who set the closing dates, it will be impossible to compare reports between the current year and the previous year.

Wrapping Up!

So we have to discussed how to close the book in QuickBooks and all the related information related to it. If you have any questions and queries related to this topic you can directly call the tech support team of QuickBooks. You can call them on their helpline number for Quick communication. You can also contact them by sending your queries to their emails

After this, we will hope, you understand what is close to the book and how to use it. If you want more detail or expert support for this, you can dial our QuickBooks Support +1-844-405-0904. Our experts will give you full attention and make it very easy for you to understand it.