Are you seeking articles that match your query about “Payroll 101: How Payroll Works For Small Business Owners”. Now you are on the right page, here you will get all the successive knowledge about this topic. Whatever information we provided to you, all are tested and verified so that all your time, money, and efforts can easily be saved. you will be served with the information which will fulfill your need. For any query regarding this topic, you may contact us +1-844-405-0904.

Ready to learn about the basics of payroll processing and your obligations as an employer? Before discussing Payroll 101 in detail, you need to focus on three main things that play a significant role in the concept of payroll.

- Pay your employees: In this, you have to calculate the gross pay and taxes withheld each pay period.

- Pay Taxes: In this, pay taxes withheld from employees’ tax liabilities along with paychecks you incur as an employer to the relevant government agencies.

- File Tax Forms: In this, it is required that the forms will process each quarter. Even if everything you owe is paid then you still have to file tax forms that report your liabilities.

To provide the right understanding we break down the payroll process into fragments and also answer the frequently asked questions from new employers who recently started working with payroll.

Table of Contents

How to Pay Your Employees

Pay your employees by following the simplest method which you will learn below.

Before your first Payroll

For particular employees you always keep in mind that you have the following forms:

- I-9 Form

- W-4 Form

- State W-4 (if applicable)

- Direct deposit authorization (if it applies)

It is mandatory to report your newly hired employees to your state agency. We named this process “New Hire Reporting”. In this form, all the details related to the employee are properly filled (If you want more information then contact your state to know how to handle this and what form you have to complete).

How to Determine Compensation Types?

Learn the Compensation Types in proper order. All have a few specifications which you can know here. These are:

Hourly

You are required to set the hourly rate for each particular employee. By accessing the state and federal wage limits, multiple employees have settled the hourly rate as well as the average market rate of the job (according to their role), education, and working experience of an employee. Employee charges according to the working hours’ rate by specifying the minimum daily limit of that task.

Salary

The salary is settled one time (it is fixed). Salary wages are set amounts, the employee will receive the same amount on their every paycheck, it is always constant. According to the rule of thumb, Determine the annual salary first, and then divide it by the number of pay periods in the year to determine the salary amount for every paycheck for an employee.

The hours of salary employers are typically fluctuating, so there is no real path you have either determining their hours unless you can keep track of their time through a time management system. For some reason, if you are willing to determine their hourly rate, then follow the simple procedure.

Tip: Divide their Annual Salary by 2080 (this amount is generated by calculating the average hour’s amount that a person works in a year 40 hours a week x 52 weeks = 2,080 hours).

Commission

These employees will get paid according to their performance. These employees will receive a percentage of their sales. Also, The pays of these employees are dependent on the number of products and services sold. Federal and state laws determined that employees will get paid at least the minimum wage.

Tips

The minimum wage paid to tipped employees is lower than the minimum wage paid to hourly employees. Tips are collected through the paycheck if the tip is paid to the credit card. It can also be collected directly from the employee if the tip is in the form of cash.

Other Compensations

Multiple ways are associated with paying your employees. Be sure to work with your state/business, or accountant to regulate what type of compensation you are required.

How to Pay your Taxes

Payroll Taxes consider all the taxes withheld from your employees’ paychecks as well as taxes you pay as an employer. The following taxes are listed below:

- Social Security and medicare

- Federal and State Unemployment

- Personal Income Tax (Federal and State)

- Miscellaneous other state taxes

Note: Most of the payroll taxes including income tax will apply to all the earnings. Although fewer taxes have a wage cap, maximum annual earnings per employee are subjected to that tax. These caps are issued, certified, and mandated by government agencies. You can either go for finding wage caps and limits, just to know the higher details on this topic.

1. Social Security and Medicare

It is paid by employers as well as employees. According to the employer’s perspective, you withhold employees as part of the taxes. Along with that, pay the federally regulated amount for the company portion. The tax rate allotted for Social Security is 6.2% and applicable to both employees and employers (a tax along with a wage cap).

Note: This tax is calculated only up to a minimum dollar amount of wages per employee each year. This current year 2020, the wage cap for Social Security is $137,700.

For most employees, the employee’s tax rate held for Medicare is 1.45%. Now it increases to 2.35% on wages over $200,000. No wage cap is allotted for Medicare tax. It indicates that the taxes are only paid for those wages that the employee earns. This exception is exempt wages. You can check out “Special Tax Exemptions.”

Note: In the starting, the employer tax rate for the Medicare tax sets to 1.45% regardless of wage amounts.

Income Tax

The amount of FIT (Federal Income Tax) associated with employees’ paychecks depends on marital status, the number or ratio of withholding allowances (exemptions) claimed on the W-4 form, pay frequency, and the projected annual income.

Additionally, all nine states will have a Personal Income Tax (names of these states are:

States: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming). It can be a flat tax rate considering the projected income. The Graduated tax rate depends on annual Income including FIT.

In some states, employees are getting paid local taxes to cities, counties, and school districts for their paychecks.

What is Form W-4: Reported By the Employee

Form W-4 has some field that is required to be filled according to the description which we provided to you.

Filing Status: The marital status describing “which tax table is used for calculating the income tax withholding”. Four options are highly available for federal income taxes, these options are:

- Single

- Married filing jointly

- Head of Household

- Married Filing Separately

Withholding Allowances: It is also known as “exemptions.” Withholding allowances will reduce taxable income by a designated amount per allowance. The IRS periodically updates the Allowance amounts. Factors include the number of dependent’s influences, and how many allowances are claimed by an employee.

Additional Amount to be Withheld: The amount added to the income tax will only be calculated by specifying a particular paycheck. Additionally, the amount of income tax withholding is based on the employee’s filing status and withholding allowances.

The W-4 form includes multiple worksheets for estimating the most accurate projection of tax liability. Fewer states will have similar forms for state tax liability. You can learn more about other details in the below section.

2. Federal and State Unemployment

Federal Unemployment Tax Act (FUTA): The FUTA along with the State Unemployment systems provides payments for unemployment compensation to workers who lost or left their jobs.

Point to know: In the years 2019 and 2020, the effective FUTA tax rate is 6.0%.

Although, most employees will qualify for the 5.4% state unemployment tax credit lowering the effective rate to 0.6%. This tax is applicable for the first $7,000 employers who paid their employees as wages during the accounting year.

If any of your employees are exempt from State Unemployment Insurance (they can be Directors or Officers). FUTA Tax will be higher. Along with that, if your state borrows some funds from the Federal Government for covering the fewer shortfalls that occur in the Unemployment Insurance Program, all employers under your state might be subjected to additional tax liability at the end of that year, just to repay the loans.

State Unemployment Insurance (SUI): Some money is reserved by all states to maintain their Unemployment funded through an unemployment insurance tax. Some cases show that SUI is only paid by the employer.

Employees who work in states such as New Jersey and Pennsylvania can also contribute to SUI through their paychecks. Most states have introduced a new SUI rate for their new Employers. Once the designed period is finished, employees are assigned according to their experience rate, which can be higher or lower than the new employer rate, depending upon the reserve bank account balance of employers. Notice is received from the State once the changes are made in rates.

Other Payroll Taxes

It includes state Disability Insurance (SDI) or workers’ compensation administered by some taxes as a tax collected through the Payroll. Many states will have the tax paid jointly with SUI can be very helpful in offering Funds to job training programs.

Special Tax Exemptions

Many types of Employees are there, and few of them are exempt from one or more payroll taxes.

Let’s take an example to help you better understand the topic, A minor working for a parent who is a sole proprietor, having nothing to pay Social Security, Medicare, Or FUTA. Additionally, fewer portions of regular employees’ wages might be exempt from one or more payroll taxes.

For example “Tax-Sheltered” and “Pretax” Insurance Plans help in saving the money of the employer as well as the employee by exempting premium accounts from all federal taxes and state taxes.

Some fringe benefits you will get, S-Corporation owners‘ health insurance will be taxed differently from regular wages.

Note: If your Company is a not-for-profit 501(c) (3) corporation, then you are not required to pay the FUTA taxes no matter who and how many employees you have in your company.

Role of Intuit Online Payroll and QuickBooks Online Payroll

“Intuit Online Payroll” and “QuickBooks Online Payroll” will handle the special taxability of wage types automatically. Suppose you are having employees who are eligible for special tax exemptions, you can mention it at the time of setting up the employees in your account. Your accountant will provide proper details of your employee category(it determines you have employees in this category). The accountant will take care of which category is well suited for which employee. Although, few employees will have to pay all the payroll taxes.

Role of QuickBooks Desktop Payroll

If you are having a “QuickBooks Desktop Payroll” Subscription along with eligible employees for special tax exemptions, you can configure this at the time of setting up the employees in your QuickBooks Desktop. Your accountant will provide proper details of your employee category (it determines you have employees in this category). The accountant will take care of which category is well suited for which employee. Although, few employees will have to pay all the payroll taxes.

Paying Taxes

As an Employer, you can cancel taxes to the IRS and the state agencies either you can pay by using a form you have provided by the tax agency or you can pay electronically. Before inspecting the timing of tax deposit due dates or deposit frequency, you have to look at a few payroll items.https://www.wizxpert.com/what-is-an-irs-1099-form-tax-tips-learn-and-support/

Constructive Receipt

It defines the rule that makes the employers responsible for payroll taxes on the date they pay their employees anyhow when they did their job associated with their specified paycheck. Many employers choose Friday to pay their employees if the employers pay only on Fridays then you have to report the tax liability only on Friday, even employees will receive the wages every day of the week.

Here we discuss a point when an employee goes ambiguous, It is when work is performed in only the Tax period but the employees are getting paid in a different tax period.

Note: The IRS will only track when employees are paid, it doesn’t involve the span of time when the money is earned.

Example: ABC pays its employees every two weeks. Employees will receive a paycheck on 3rd January 2020, covering the whole work performed during the pay period on 16th December and 27th December 2019.

Question: In which month does the tax liability for this payroll fall?

Answer: ABC’s payroll is considered part of his January 2020 tax liability, even though the pay period fell completely in December 2019.

Lookback Period

It defines the reference period used by the IRS for regulating your federal tax payments’ due dates. The IRS is capable of evaluating your tax liability for 12 months of a year and also determines whether you are a semiweekly or monthly depositor for the upcoming year. From today the upcoming year is 2021. Fewer new employees are monthly depositors.

Note: For 2020, the lookback period is July 1, 2018, to June 30, 2019.

Deposit Period

It involves the span of time during which tax liabilities collect for each deposit on its due date.

Federal tax deposit schedules

All the deposit schedules which we described below are applied to all federal taxes rather than FUTA.

Monthly Depositors: You become a federal monthly depositor in 2020 if your Company’s federal tax liability lies under the lookback period of July 2018 through 30 June 2019 was less than $50,000. This is the reason that’s why we said all new employers are Monthly depositors. Monthly Depositors will only pay taxes for the particular month by the 15th of the next month.

Look at the example, Taxes of June are due by the 15th of July if on this day any weekend or federal holiday presents then the due taxes are paid on the next banking day.

Semiweekly Depositors: If you have lookback liability and it is greater than $50,000 it indicates that you are a semiweekly depositor. You have to pay taxes on three banking days at the end of the semiweekly period in which your liability is accrued.

The week is split into two parts by the IRS. You can see below:

- Wednesday, Thursday, and Friday

- Saturday, Sunday, Monday, and Tuesday

Taxes that are accrued during the Wednesday through Friday period will be due in the following period. In a similar way, if taxes are accrued during the Saturday through Tuesday period are due on the following Friday. Most of the cases will represent that when a federal holiday comes (it is on July 4 due to Christmas) in a week, if you are a semiweekly Depositor then you will get one extra day to clear your due taxes and to make the tax payments.

What are the Exceptions to deposit schedule rules?

It is based on three main exceptions to the monthly and semiweekly tax deposit requirements:

Next-day deposit rule: During a deposit period, if you are ready to accrue $100,000, or more in the context of federal tax liability at any point then it generates a result to be a single payroll, it can either result from multiple payrolls inside a single deposit period (it can be either monthly or semiweekly).

Let’s take an example: Suppose you are a monthly depositor and you only pay your employees a one-time bonus, and it resulted in more than $100,000 in liability on a single day, you are required to pay the due amount as soon as possible. You can also become a semiweekly depositor whenever your lookback liability falls lower than the $50,000 threshold, again.

Quarterly Exception: If less than $2,500 in federal taxes for a quarter is owned by you then can choose to pay whenever you are ready to file your taxes at the end of the quarter(rather than making deposits during the quarter). If you have no hint how much your business will grow, you must require to make more frequent deposits, it is just because of IRS penalties if you earn more than $2,500 at the end of a quarter and have paid tax deposits.

Annual Exception: If the IRS notified you that you are 944 filers in writing, and the total of your federal tax liability is lower than $2500, So now you have to file federal tax deposits annually. The 944 Filing status is only for employers who pay very small wages to their employees, typically paying $4000 or less in annual wages.

How to Pay FUTA and SUI taxes

FUTA and SUI taxes are different from federal taxes. Always keep in mind that you have to pay the FUTA taxes on the last day of the month following the end of each quarter.

- April 30 (for Q1)

- July 31 (for Q2)

- October 31 (for Q3)

- January 31 (for Q4)

Points to Remember

- Suppose you accrue lower than $500 of FUTA liability in a quarter, you are not required to maintain or make the deposit until the following quarter. If the liability remains under $500 for the entire year then you have to make an individual payment at the end of the year(it must be before the 31st of January).

- You have to pay SUI only one time per quarter to your state. Intuit Online Payroll Enhanced will also start sending notifications when your SUI payments are due. You start receiving prompts or notifications from Intuit.

State withholding schedules

Similar to IRS, states establish deposit schedules for paying income tax you have withheld from your employee’s paychecks. When the first time you have registered with the State Revenue Agency, which will provide the notification of each update of your state deposit schedule.

SUI Taxes

Same as FUTA, SUI Taxes are repeated once a quarter, regardless of the employer’s size. Additionally, other taxes that are administered by a state’s unemployment commission including Arizona’s Job Training Tax or New York’s Reemployment tax, tend to be jointly paid along with the SUI tax on a quarterly schedule.

When we talk about Florida and Nevada, where no state taxes are withheld from employee wages. SUI Taxes is the only one that provides a facility to payroll tax employers so that all the employers can pay taxes quarterly.

How to File your Tax Forms

Now you are ready to provide accurate paychecks to all your employees and pay all the payroll taxes you have, including one more basic responsibility. Here you will learn the overview of all types of form filings required by employers.

Federal Forms

- Form 941: Few employers have filed this tax form every quarter with the IRS. This compares federal payroll taxes owed with taxes paid during the quarter just to check out whether your payments were timely. Or either you have a due balance in it.

- Form 944: Employers who will get written notice from the IRS can easily file a 944 Form annually rather than Form 941 for each quarter. Similar to 941, it reports wages and also calculates federal payroll tax liability. Most of the 944 payroll filers will have to pay taxes once a year.

- Form 940: All the employers who pay FUTA file, this tax form at year-end with the IRS. When we are talking about Form 941, compares FUTA tax liability along with FUTA tax payments just to check out, whether your deposits are timely or not. Also, check out the due balance.

- Form W-2: All employers will provide the W-2 form to each employee at year-end as an earnings record for fulfilling income tax purposes. You are also responsible for filing the tax form W-2 with the Social Security Administration.

State forms

Wage reports: Reports pages will be paid to each employee for a given quarter. They are sometimes combined along with quarterly contribution reports calculating SUI tax owed. Additionally, it is accompanied by the SUI payment at the end of the quarter.

Note: For each quarter most of the states need both wage report and contributor report either as a separate form or as contributor forms. Many states also need quarterly reconciliations for their state income tax.

Annual Reconciliations: At the end of the year, some states will require filing an annual reconciliation for income tax. It may or may not be accompanied by copies of the employee’s W-2s. Cities, Counties, and School districts will access taxes that may require both quarterly and annual forms. It may require copies of W-2 forms. Check with each agency to which you have to pay tax.

Breakdown of a paycheck

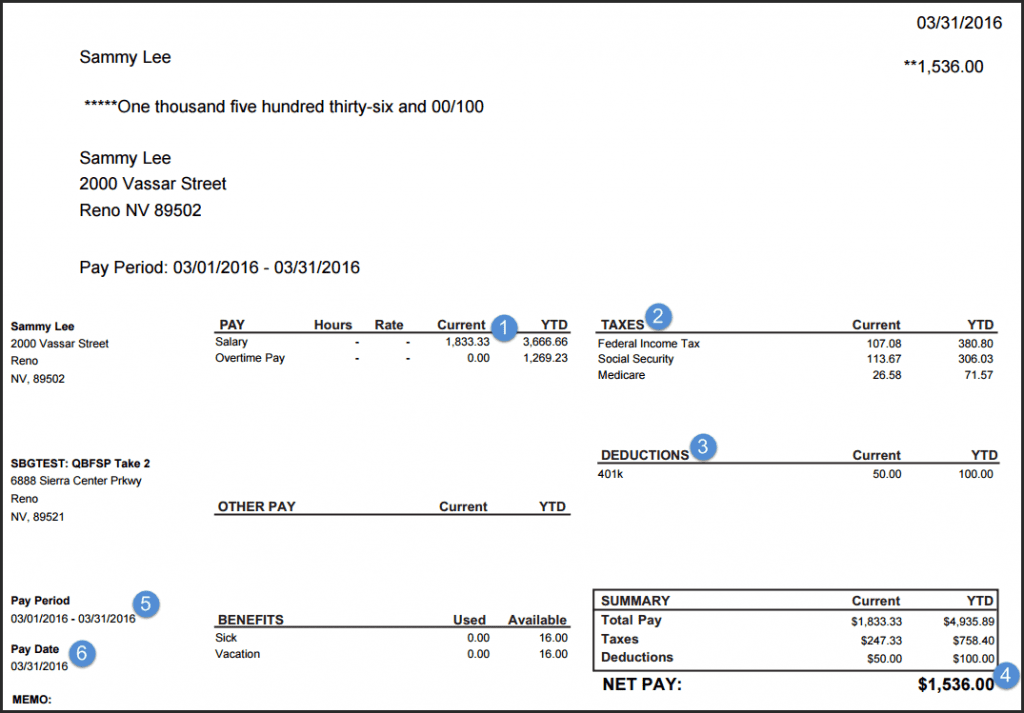

Online Payroll

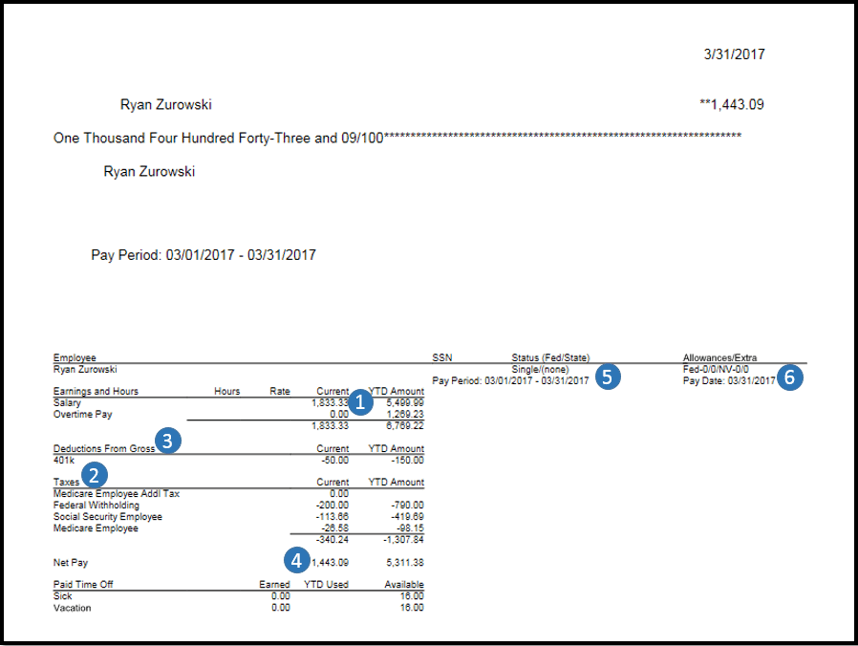

Desktop Payroll

1. Gross pay

Gross pay will be calculated as the amount you have to pay to the employee without deducting any taxes in it.

- For calculating the Gross Pay for hourly employees: gross pay = hours x rate

- For Calculating the Gross pay for salary or commission-based employees: gross = flat amount

Note: This amount is usually determined by figuring out the annual salary and then start dividing it by the number of pay dates in a year.

2. Taxes

Employees owed taxes will be taken out of the gross pay. It typically includes:

- Federal income tax

- Medicare

- Social Security

- State Income tax

Just because you are an employer then it is your responsibility to hold and get paid all these taxes on the behalf of the employees. As an employer, Employee-owned taxes will come at no additional cost to you, as these amounts are already included in the expense for gross pay.

Although you are also liable for the employer owed taxes, it typically includes federal and state Unemployment along with the share of medicare and Social security. It is not included on a pay stub in QuickBooks, these do not pertain to the employees, also they are not worried or required to know about these expenses. You can easily find these amounts easily by visiting the “Tax liability” or “Total cost” reports offered by Intuit Payroll Services.

Note: If you are willing to get a “QuickBooks Desktop Payroll” subscription, you can browse these amounts inside the “Pay Liabilities” or “Payroll Summary” reports in QuickBooks.

3. Deductions other than taxes

In this, typical deductions include:

- Health

- Vision

- Dental Insurance

These are optional, but the employees will also have some involuntary deductions that include garnishments, and child support will come inside it.

4. Net Pay

It comes inside the employee’s take-home pay. On this point, all the taxes and deductions will be taken out. Employees have to cash their checks for receiving the amount. Or if they are setting up for the direct deposit, it treats as the amount that directly hits their bank account.

5. Pay Period

It is the time period when the work was performed. Pay periods can either be weekly, every other week (Semiweekly), or Monthly.

6. Pay Date

The pay Date is the first day when the employee can get easy access to the funds. In most cases, it is the day when employees get the check-in in their hands or if they are interested to set up direct deposits then this is the date you will receive the funds in their account.

To know the importance of this date you are required to visit the “Constructive Receipt” and be ready to get the higher details on this topic.

Here’s a table that represents what to do after every payroll and at certain time frames:

| Event | After every payroll | Every month | Every quarter | At year-end |

| Pay federal income tax, Medicare, and social security | These taxes are due after each particular payroll if you’re one of the semi-weekly depositors. | These taxes are due by the 15th of every month if you’re one of the monthly depositors. | ||

| Pay state income tax | These taxes are due after each particular payroll if you’re one of the semi-weekly depositors. | These taxes are due by the 15th of every month if you’re one of the monthly depositors. | ||

| Pay state unemployment | The State Unemployment taxes referred to as (SUI) taxes are due at the end of every quarter | |||

| Pay federal unemployment | Federal Unemployment (FUTA) taxes need to be paid at the end of the quarter once the liability for the year exceeds $500. If this threshold is never met, these taxes will be due at the end of the year. | If the liability will never reach to $500 the Federal unemployment (FUTA) taxes are due at the end of the year. | ||

| File Form 944 | File Form 944 will be very helpful to reconcile your employee wages and federal taxes if you are not one of the 941 filers at the end of the year. | |||

| File Form W-2 | This Form can be File by the end of January | |||

| File Form 941 | File Form 941 will be very helpful in reconciling your employee wages and federal taxes at the end of the year. | |||

| Filing of State Unemployment forms | Here you can easily File your state unemployment Form along with your SUI payment | |||

| Filing of quarterly state income tax forms | For reconciling your employee wages and state taxes, you have to File quarterly state forms at the end of every year. | |||

| Filing of Annual State Income Tax Forms | You have to read out the Year form annual end agency due dates (The tax year 2019). For the state annual due dates of the year. | |||

| File Form 940 | For reconciling the FUTA, simply file Form 940 at the end of the year. |

Top 5 Frequently Asked Questions (Payroll 101)

It defines the amount of control having employers on their workers and regulates whether or not the worker is an employee or an independent contractor. If the employer will check out the whole, controls and take care of “what must be done” and “how the work gets done”, and also offer the right tool for finishing the work in a minimum time period then we can say the worker is an employee.

If the worker focuses and takes care of “how the work is to be done” then the work is self-employed. Self Employed workers will have their own tools and techniques and can run their independent businesses with multiple clients. The term used to say for self-employed workers are sole proprietors.

For getting the successive details about whether a worker is an employee or a contractor you can either go for IRS Publication 15 and Employer’s tax guide.

Whenever you hire a first employee, you are required to register with both the Federal and State government. A registration will generate a complete record of the employee. At the time of registration, you will provide the federal Employer Identification Number (EIN) and usually, a state EIN. In many states, it is essential to register with both the state Revenue Agency. The easiest and simplest way to register and for receiving the federal Employer Identification Number along with faster results which we offer to you is “Online”.

For this, you have to fill out a W-2 form just to declare the status and allowances. Once you have done it, you can easily set up each employee in the Intuit Payroll by manually entering their information. Intuit Payroll services will now offer a facility for calculating the withholding taxes. Also, you can withhold voluntary deductions including health insurance and retirement plans.

Worker’s Compensation is the state-administered program needed to pay for injuries that will occur in the course of employment. Worker’s Compensation Insurance will be very helpful for all employers of all states or regions of the USA. You always keep in mind that, If you are an employer of a small business then you must contact your Insurance Broker.

Note: It is very essential that you have adequate workers’ compensation insurance. If due for some reason your employee goes injured during their working hours on the job responsibility you can be personally liable. You are not only responsible to pay for the medical treatment even the disability payments suffered by employees during the period in which an employee is unable to do their job.

In this, the users who run small businesses either owners, sole proprietors, or partners don’t earn wages and they are not to be taken as an employee.

Note: Even some LLC members and S-Corporations owners are also not to be treated as employees.

For getting confirmation about the worker’s employment status, don’t do anything more just talk to your accountant or you can either check out IRS Publication 15 and Employer’s tax guide to get the right details in very little time.

Final Note

Last but not least, all the details related to Payroll 101 either belong to payroll taxes paid by Self Employed Workers, Owners, Employees, and Employers we cover everything in this article. But if you still have any confusion in your mind then get our QuickBooks Online Payroll support through our Intuit Certified ProAdvisors by calling on our help desk 24/7 technical support number +1-844-405-0904 and get Immediate Support by staying connected with us.